If you have a passion for photography (or illustration/videography), you might have considered turning it into a source of passive income. However, it takes more than just a collection of photos to create a successful stream of passive income. You need to understand market demand, meet technical criteria, be consistent in uploads, understand legal requirements etc. Moreover, building a portfolio takes time and effort, pushing the “passive” part of the income into the future.

But even if you’ve done so, will your content sell “forever”? Even by using a very simple logic, the answer is “No”. Advertising, which is arguably the biggest customer of stock photos, will unlikely use photos from 1980s to promote products from 2020s. Therefore, it’s clear that the lifetime of an image has it’s limits. But what are they exactly?

In this blogpost we will try to answer this question as well as it’s humanly possible. Steve Heap from Backyard Silver has agreed to share his detailed earnings data since 2007 so we could analyze it together and understand the nature of the stock photo income “half-life”.

About this study

First of all, this research would not be possible without Steve Heap. Steve is one of the well-known microstock contributors, due to his blog Backyard Silver, where he shares his earnings data, microstock industry insights and more. His microstock portfolio, counting some 15,000 images and video assets, is being sold on 15 most popular agencies, like Shutterstock, Depositphotos or Adobe Stock. His total monthly earnings are around $3,000 which is a great result for pretty much anybody. If you’d love to learn more of his insights, make sure to check out his blog.

Secondly, a big thank you to folks from Microstockr, who helped to prepare Steve’s earnings data in a way that would be convenient to use in this study. Microstockr is a very useful microstock earnings tracking platform. Highly recommended if you have earnings want to be on top of which images actually sell and how to optimize your portfolio to earn more.

The “miracle” of passive income

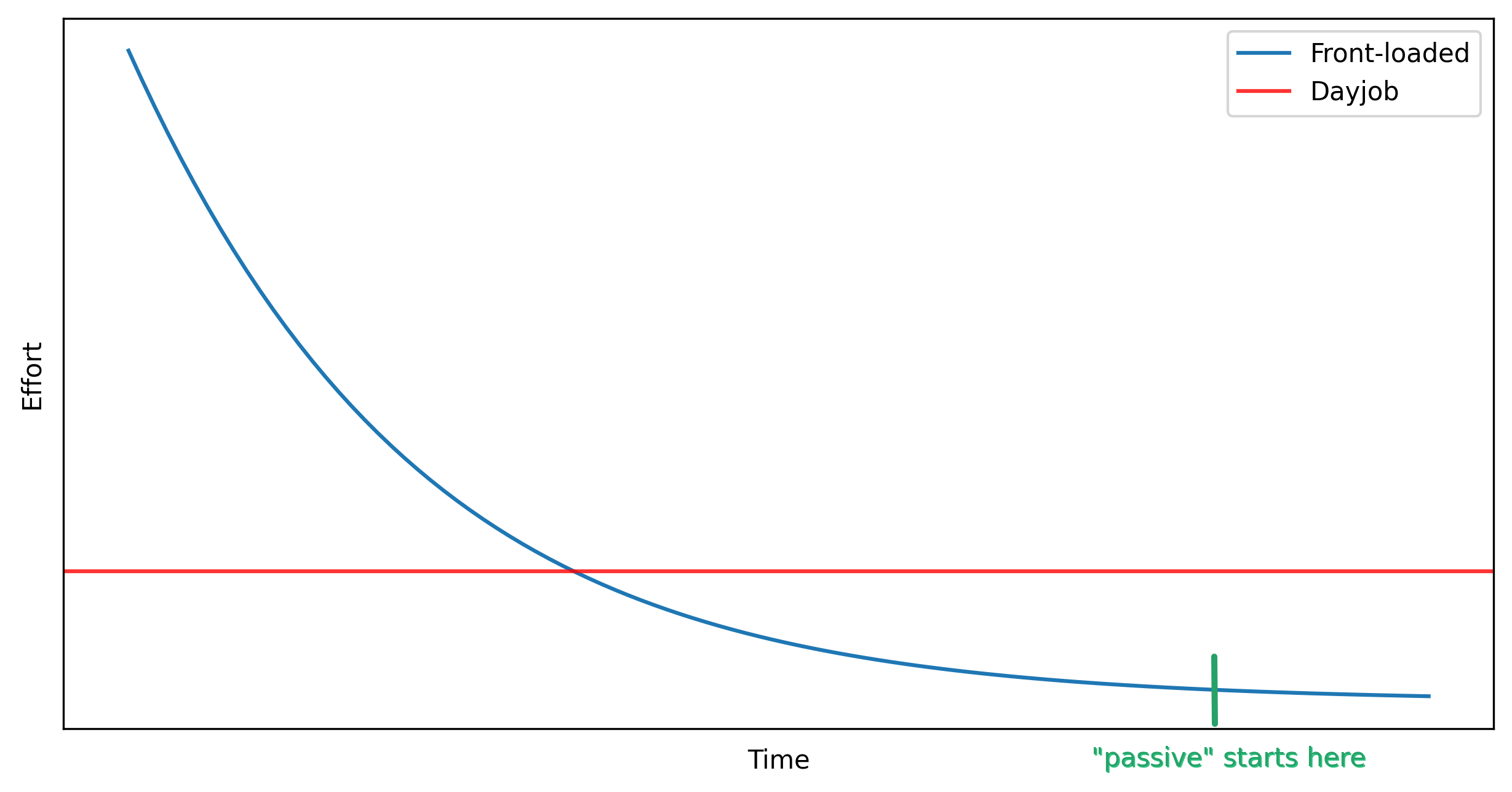

Before we get to the “meat” of this blogpost, it can be useful to align on the concept of “passive income”. It is becoming a more and more popular concept, but many people get it somewhat wrong. Passive is not “less effort”, passive simply means “front-loading”.

For 'passive' income, effort to start is the largest

The amount of work needed to generate passive income is concentrated in the beginning. Unlike, say, your day job, where the amount of effort is more or less evenly spread across time. What makes the “passive” income passive is the part where the amount of effort goes flat in the end. With stock photography, this means that you work on taking the photos, editing, keywording and uploading but from that point, the effort on that particular image is complete and it, hopefully starts to sell and continues with no further input from the contributor.

If you accumulated many of these flat effort chart lines, eventually you will receive enough passive income to allow more breaks from uploading. It does not mean you can totally stop working, as you will read later, but possibly taking larger vacations or more of them.

Microstock photography as passive income source

Microstock photography generates income by licensing your photos to individuals and businesses around the world. Once you upload your images to the agency website, they become available for purchase. Buyers need photos for various creative projects, such as blogs, advertisements and publications.

When a buyer downloads your image, you earn a royalty fee that is typically a percentage of the sale price. The fee varies depending on the platform, license type, and the size of the image downloaded. While the royalty fee may seem small, it can add up over time as you build a portfolio of high-quality images.

The beauty of microstocks as a passive income source is that once you have uploaded your files, you do not need to do almost anything else. The microstock agency takes care of marketing, promotion, and distribution of your images, leaving you free to focus on creating more content or pursuing other projects.

The hard part here is to create a large enough portfolio, be consistent, and understand the trade-offs of this “passive” income.

Large portfolio sales, at a glance

Steve has been selling photos on microstock agencies since 2007, having accumulated some 369,000 sales from his c.a. 15,000 files. He’s undoubtedly a veteran of this industry and we can learn a lot from him. His portfolio is not very niche so it can be a representative sample of a random microstock portfolio.

To understand what we’re working with, here are some larger-scale quantitative charts, that allow to understand his portfolio and sales better.

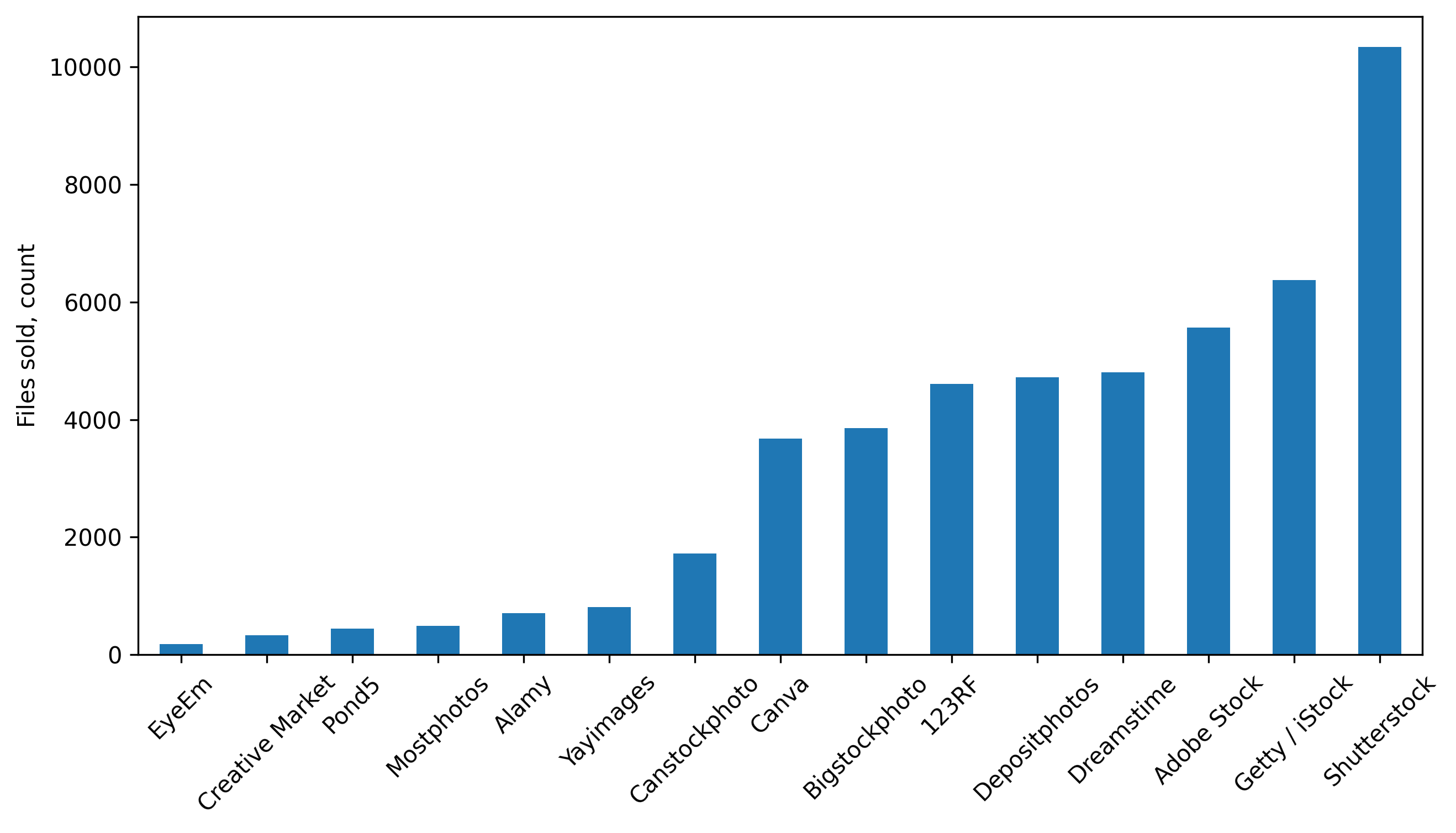

Amount of files sold per agency (lifetime)

Steve managed to sell 4-6 thousand different files across majority of the agencies, having Shutterstock with 10 thousand sold files as an outlier. Note that these are files that were sold, not the total amount of files in his portfolios (15 thousand). Number of files sold does not translate into earnings directly, because of the royalties differences, but it can show your chances to sell the files in general. It would be great, in theory, to just work on and upload images that are going to sell to minimize the up-front effort, but experience has shown Steve that is it almost impossible to judge in advance which of his potential uploads will actually sell and he also finds that different images in a series sell on the different agencies.

Note: Adobe acquired Fotolia in 2015 and rebranded as “Adobe Stock”

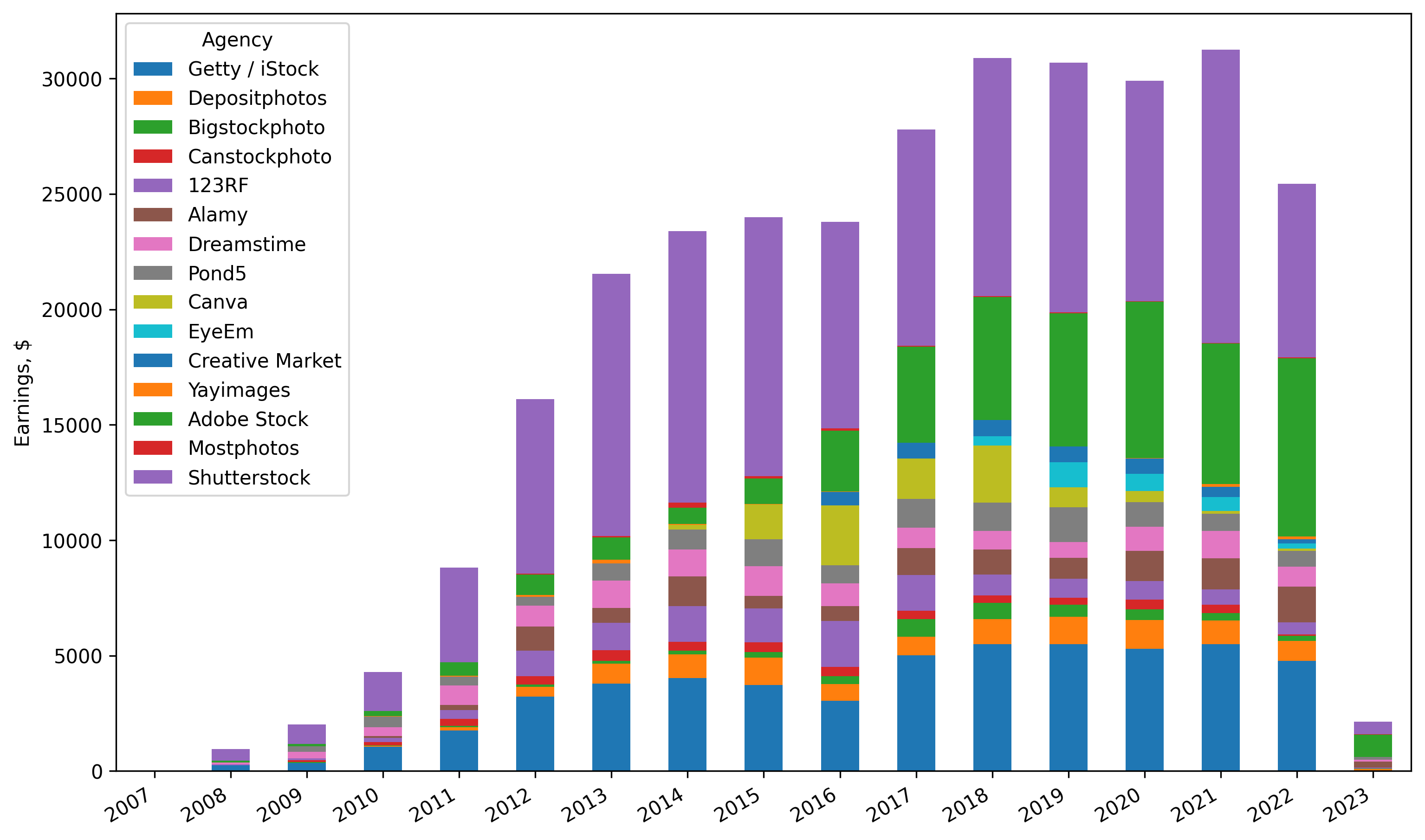

Earnings per agency per year

If we plot the earnings per each agency per year, we see that Shutterstock (purple) is the undoubted leader, followed by iStock (blue) and Adobe Stock (green). Other agencies combined bring as much profit as Adobe Stock or iStock alone. If you squint, you can notice on the chart the rise and fall of Canva, as a stock agency. This is because they made a major shift towards paying contributors based on their share of total usages on their platform. As a result, sales of individual images are no longer reported.

How much your files can earn

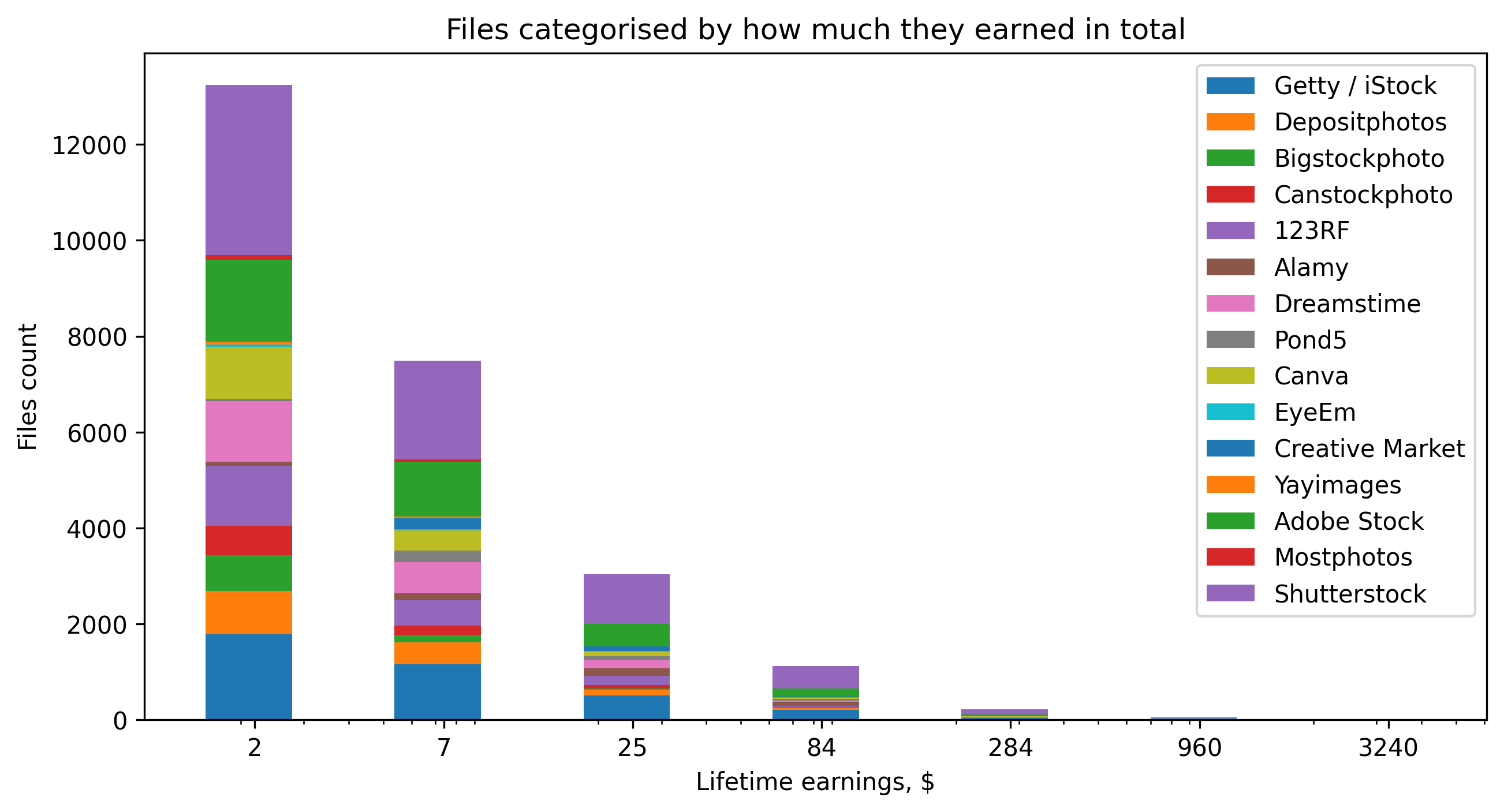

Having a large portfolio is one thing, but are all the files being sold equally well? If not, what is the difference? Here we will try to see what are some of the file groups by how much income they generated. This comes mostly from pricing plans differences at different agencies and customer demand for the content you produced.

Note: horizontal axis is scaled exponentially (1, 10, 100, 1000) to show the data closer

Now, this is a very important chart so we’ll stop here for a bit. Horizontal axis shows lifetime earnings and vertical axis shows how many files have produced these lifetime earnings. Data is split per agency.

Let’s take a look at the leftmost group of files, that generated the least income (horizontal axis) - $1-2 in the lifetime. You can see that this group is the most numerous (vertical axis), having more than 13 thousand files in all agencies combined. This means you received $1 x 13,000 = $13,000 from these low-performers in a lifetime.

Moving to the right, take a look at the middle group of files that brought around $84 in the lifetime (horizontal axis). It is visually less numerous group, counting close to 1,000 files in all the agencies (vertical bar). Doing a napkin math, it accounts for $84 x 1,000 = $84,000 from these middle-performing files.

And finally, let’s look at the “best-sellers”, that brought around $960 each in the lifetime (the right-most group). Their numbers are much lower, averaging around 50 across all agencies. It’s hard to produce best-sellers consistently for all agencies. Approximate earnings being $960 x 50 = $48,000 (less than the previous group).

Note that actually every vertical bar is an interval of earnings, but we are using just the middle of the interval for rough income calculation.

Role of the best-sellers in your portfolio

Best-sellers is a topic that frequently produces a heated debates so we’ll try to see how much impact they had in the Steve’s portfolio. By best-sellers I mean the files that brought individually the most income. It’s the right-most group on the previous chart.

To analyze their earnings, we will pull 100 of the best selling assets that Steve has produced. Here are the top-10 of these 100:

| # | Agency | Photo ID | Earnings |

|---|---|---|---|

| 1 | Shutterstock | 70533907 | $3673 |

| 2 | Shutterstock | 112994140 | $1799 |

| 3 | Shutterstock | 116711947 | $1292 |

| 4 | Shutterstock | 94525675 | $1267 |

| 5 | Getty / iStock | 1162845770 | $1194 |

| 6 | Shutterstock | 101749282 | $1117 |

| 7 | Adobe Stock | 337104491 | $1058 |

| 8 | Pond5 | 11315938 | $1055 |

| 9 | Shutterstock | 764799502 | $1021 |

| 10 | Shutterstock | 109014221 | $956 |

If you’re curious, this is the number 1 in the list:

Steve's best-selling photo is a cat

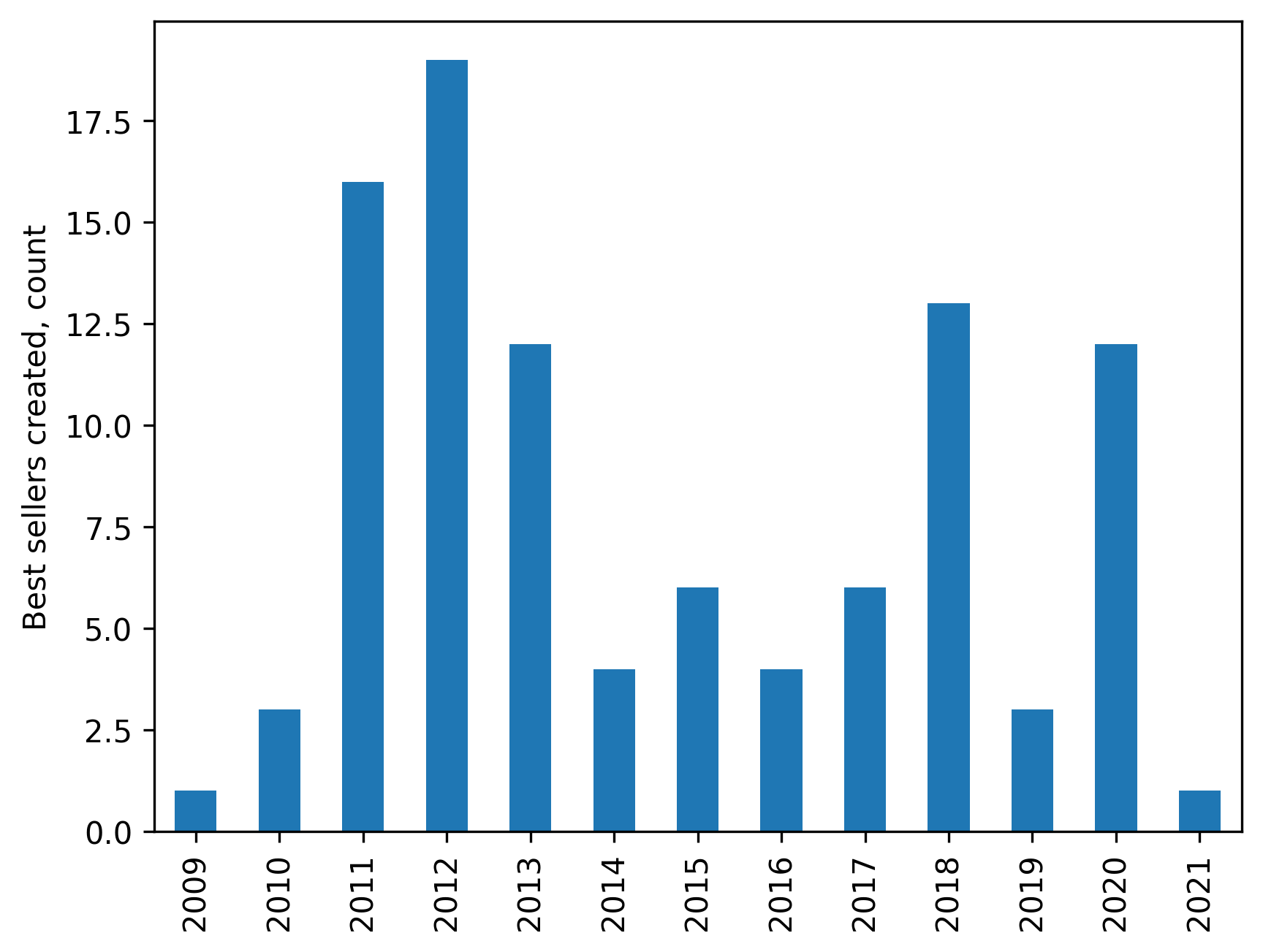

Let’s see when Steve produced his 100 best-sellers over the years:

How many best-sellers were produced per year

I would conclude that producing best-sellers for Steve was mostly luck, given that there was no clear pattern in the years (e.g. more best-sellers with more experience). What is also interesting, is that Steve produced 12 best-sellers in 2020, when microstock industry was reportedly “dying” already (accordingly to contributors’ panic).

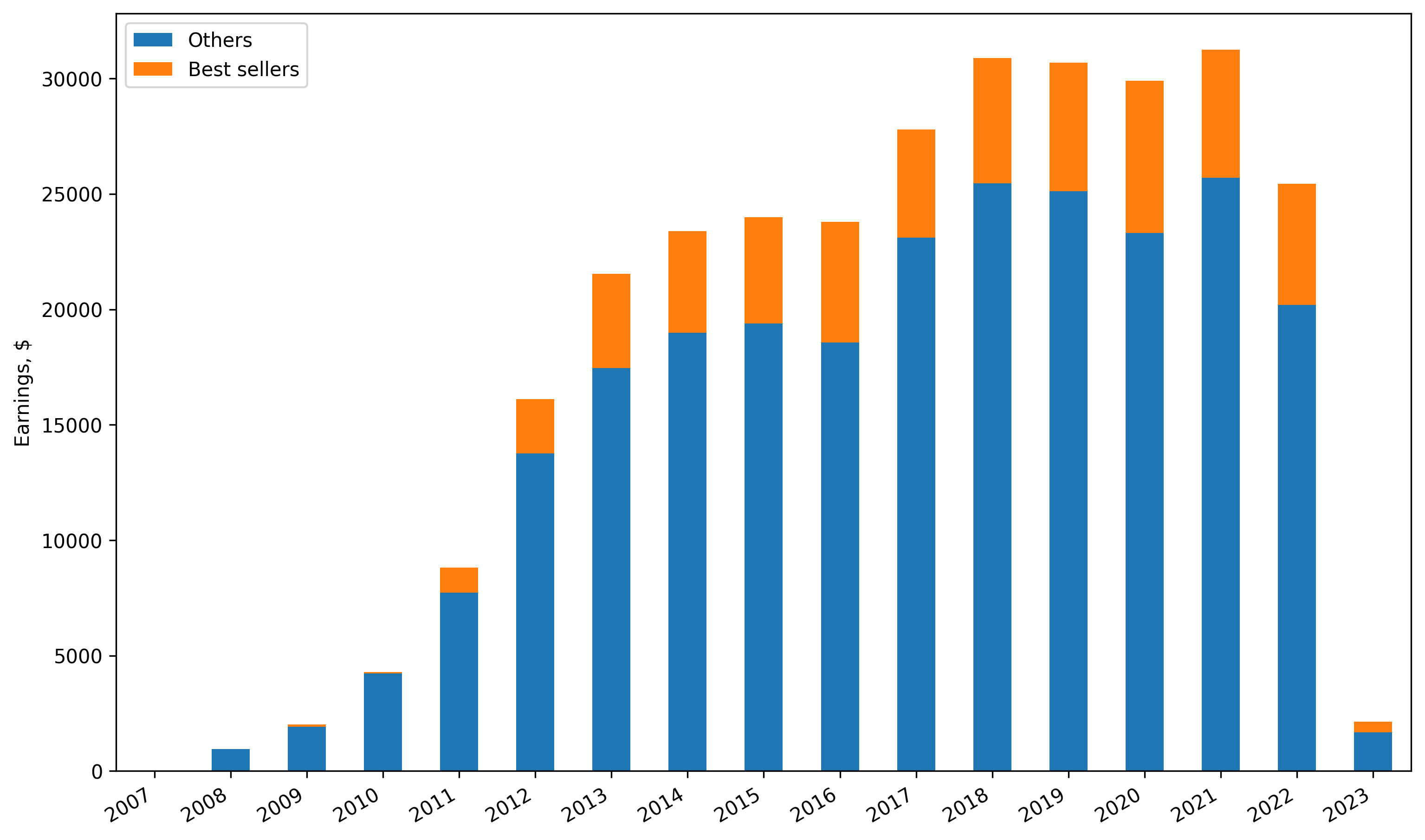

However, it’s interesting to see the impact of best-sellers on sales:

Sales of the best sellers comparing with others

From this chart it’s clear that the majority of Steve’s income is generated with “other” files. While best-sellers account for an impressive 15-20% of the income some years, it’s the other “routine” work that brings the vast majority of the income.

How fast passive income fades away

a “half-life”: how much time needs to pass until your sales half (microstock jargon)

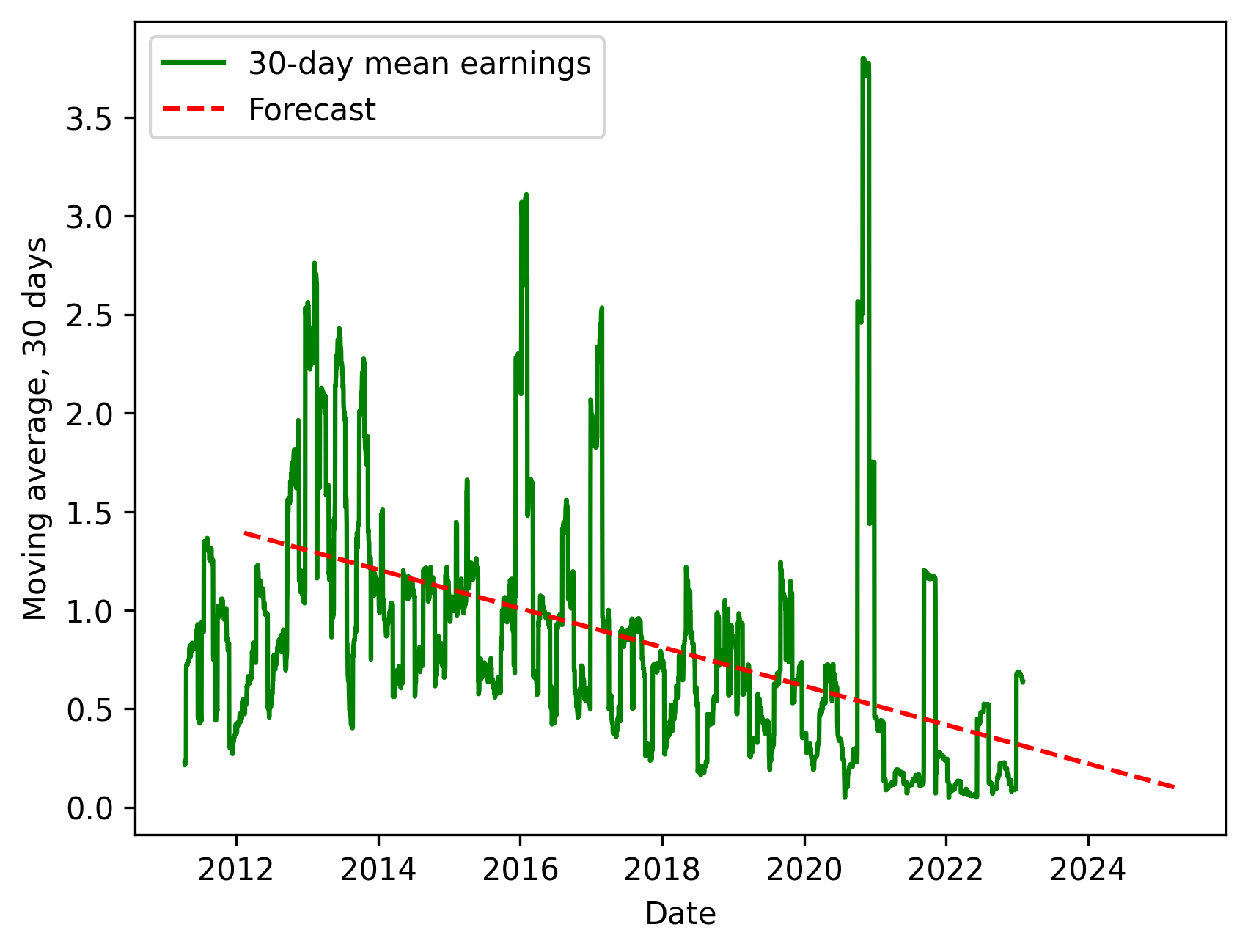

It is, of course, obvious that cats will continue to rule the world be in demand forever. However, maybe not the breed that’s on Steve’s photo or not the colors of his cat or not the age. We actually can roughly estimate the future demand of this photo, based on sales as well as to see where the general trend is going.

Best-seller cat sales over time, smoothed by 30 days

Based on the current data, we can see that the picture likely will be selling for some 14 years in total, dropping 7.6% sales each year on average. It’s a really good result though. For example, one of the best-sellers, discussed in this earlier blog, has a decline of 10.3%.

Now, this is a rough estimate, but it is quite sufficient when aggregating over a lot of sales data. While exact days or months might be wrong, amount of years has a low error. In fact, this is what we will do: the same exercise as the we did for a single best-seller, we will repeat for the whole Steve’s portfolio over different agencies.

To do that, we make few assumptions about sales data:

- start estimating decline curve after 1 year of sales (the “ramp-up time”)

- dropping all sales with less than 4 years of data (data cleaning)

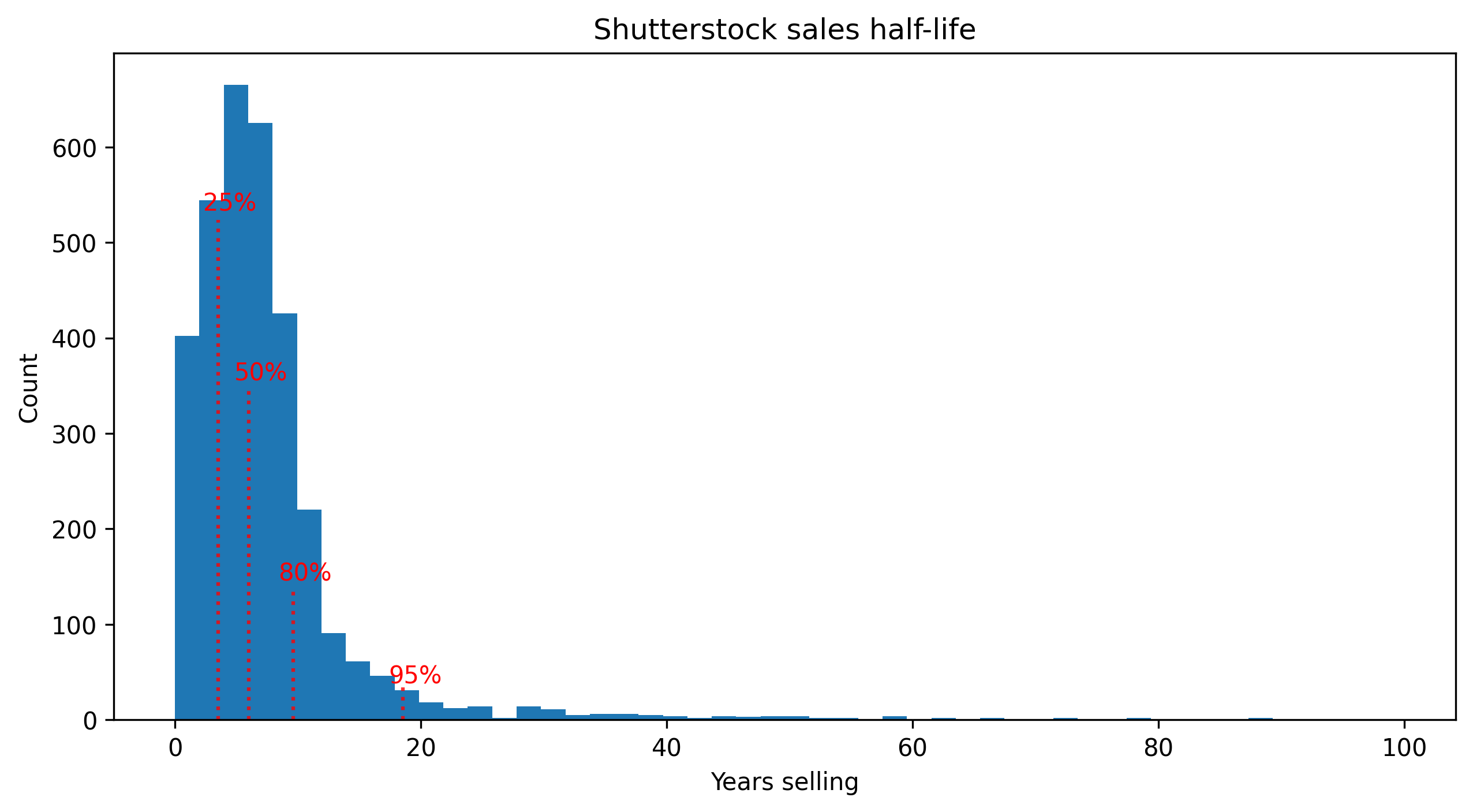

Shutterstock

The obvious first candidate for such analysis is the agency where Steve has the largest amount of sales: Shutterstock.

Horizontal axis shows the estimated number of years the photo or video will sell and vertical axis shows how many files share the same estimate. For convenience we’ve also put the percentage of the portfolio size on the chart in dots.

So what this shows us, is that some 50% of the portfolio will sell for 7-8 years, 80% will sell for 10 years and almost the whole Steve’s portfolio (95%) will stop selling in 18 years. Bad news is that 25% will stop selling just in 4 years, which is quite a large number. Note, that these 25% are probably not the 25% of best-sellers (actually, quite the opposite), but it’s still a lot.

There are a couple of outliers that yield some insane amount of years, but we will not take them into account as they had sales spikes that skewed the picture.

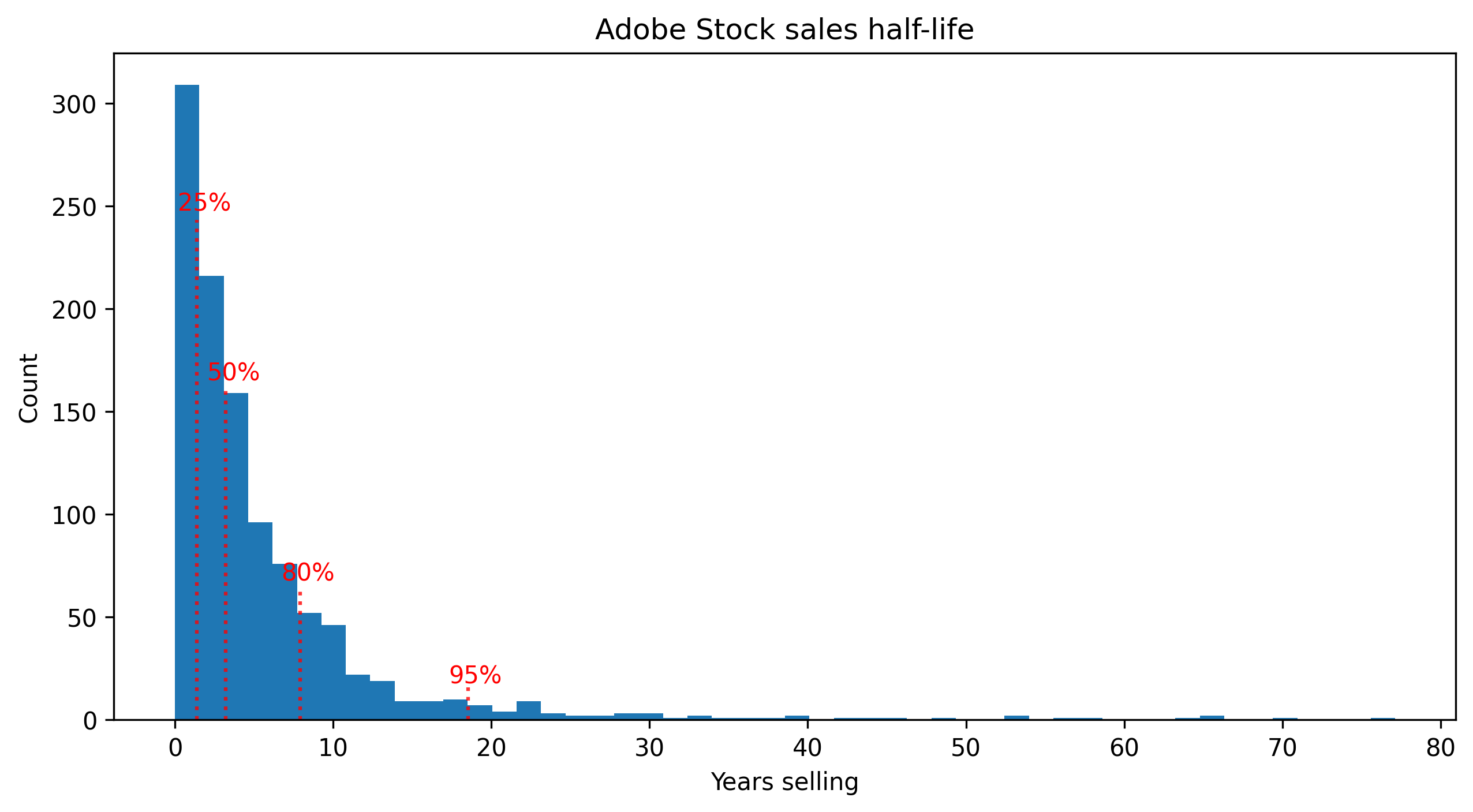

Adobe Stock

A close follower, Adobe Stock, has a similar picture, shifted more towards left.

While the 95% mark is the same at around 18 years, the Adobe Stock portfolio shows a steeper decline overall, having 25% of the sales to vanish in just 2 years and 50% in 4 years.

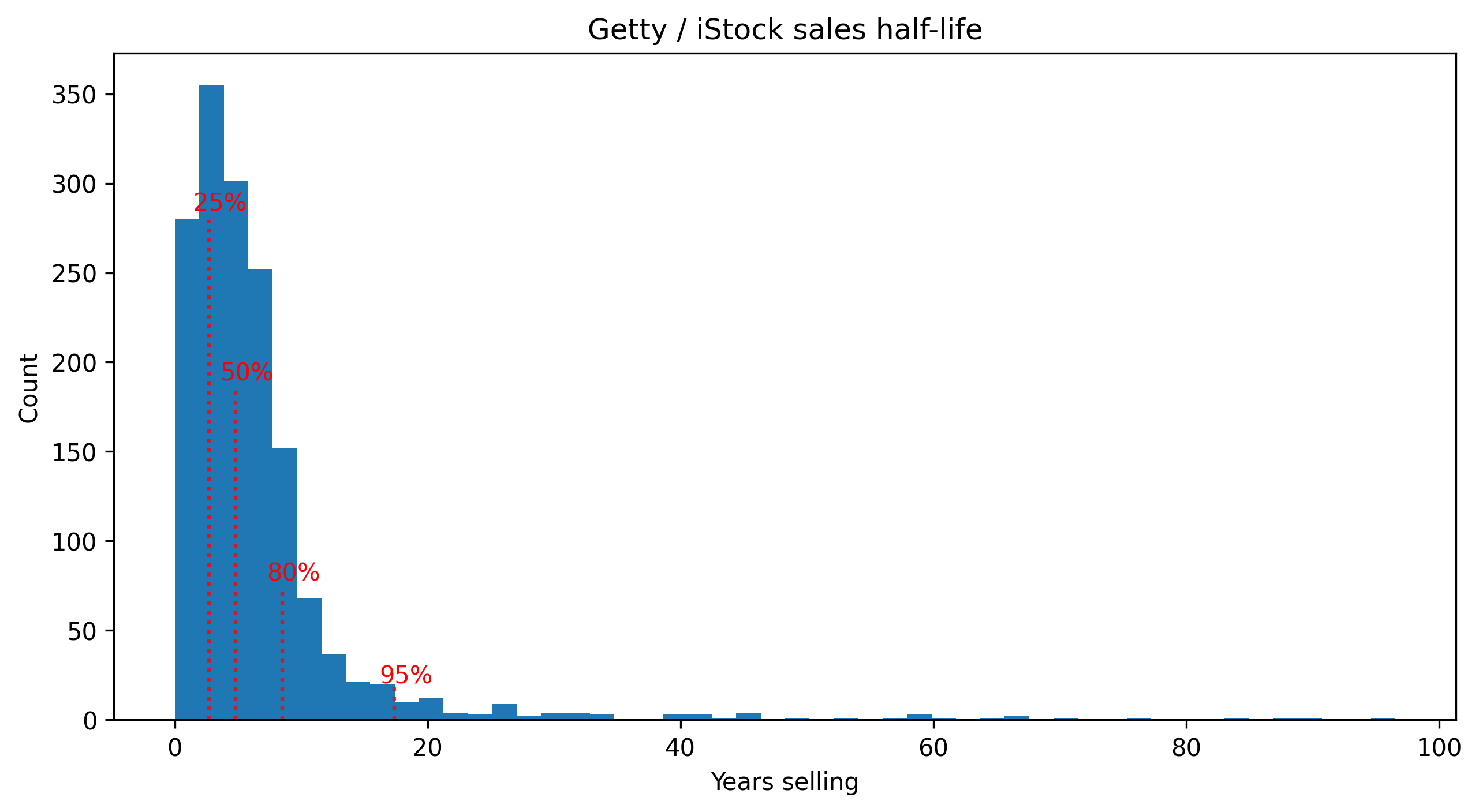

Getty / iStock

Another outstanding earner from Steve’s portfolio, iStock, shares a similar picture with Shutterstock.

Getty / iStock has less steep decline in portfolio aging, than Adobe Stock, sharing similar numbers as Shutterstock.

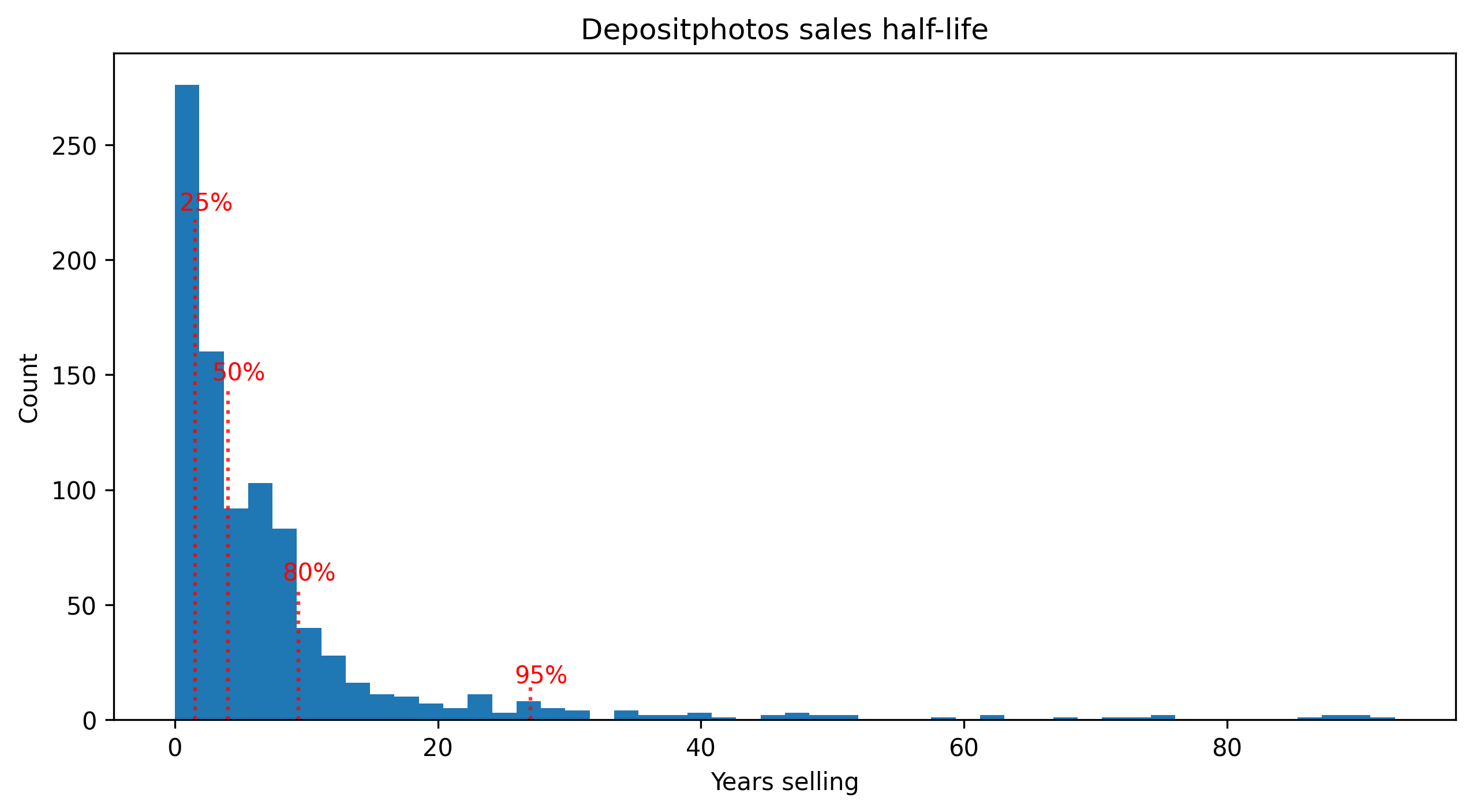

Depositphotos

Depositphotos performs well for many contributors so we’d want to check how does it work for Steve.

The picture initially is as steep as Adobe Stock, with 25% of sales disappearing after just 2 to 3 years. However, later the decrease becomes less steep, having 95% mark crossing 20 years, unlike previous agencies.

Strategy takeaways from sales data

The most important lesson is probably that however large your portfolio is, 95% of it will quite likely stop selling in about 20 years. And that as much as 25% of your sales can vanish in the first 2-4 years, that also informs the speed with which you might want to produce the content. This sounds discouraging at first, but microstocks never were get-rich-quick scheme.

Looking at how much you can earn, it’s easy to see that the majority of money actually comes from low and middle-earners, multiplied by large numbers. Highest income comes from too few files to hope to make a difference. Even the lowest earning category of Steve’s files that produced as little as $1 for the lifetime (!), multiplied by 1000 of files, multiplied by 10 selling agencies, already produced $10,000.

The lesson would be not to count on best-sellers too much (unless it’s a cat). Their creation is a subject to chance and the larger part of the earnings is produced by accumulation of not-so-best-sellers anyways. This is somewhat emphasizing the value of steady uploads, rather than a betting on a chance.

Looking at the portfolio size, it’s clear that Steve would have earned comparable amount of money, having produced only 4-6 thousand files that sell more or less consistently across all agencies. While this is truly something one cannot know in advance, it’s clear in the hindsight. Before working on a theme or an idea, you can estimate the output by checking competition in advance.

And it’s hard to emphasize enough the need to sell at different agencies. In fact, if you look at the very first sales count chart, you can see the list of agencies you should prefer to work with: Shutterstock, iStock, Adobe Stock, Dreamstime, Depositphotos, 12RF, Bigstockphoto and Canva. Steve’s earnings from half of the files were essentially multiplied by 8 just because he uploaded to many agencies.

To sum it up, microstock photography is not a get-rich-quick scheme, but having the right strategy and tools, you can play it well over the long time.