It is my great pleasure to showcase analysis of microstock contributor survey of year 2024. We asked around 30 questions via Xpiks website, MicrostockGroup forum, Facebook pages and collected incredibly interesting data. There are so many things to unpack, that survey results analysis is split into few parts. Part, that you are currently reading, is focusing on topics, related to earnings, work/business and risks.

About this survey

Big “Thank you!” to every contributor who filled out the survey! Without you it wouldn’t be possible.

Microstock contributors, surveyed by Xpiks, include close to 250 members:

- from

59countries around the globe - from barely any and up to more than

15years of experience in the industry - having tiny portfolios or up to more than

50,000assets - earnings from less than

$100per month to more than$5,000per month - working from less than

8hours per week to full-time - creating all sorts of content

Earnings analysis

General income statistics

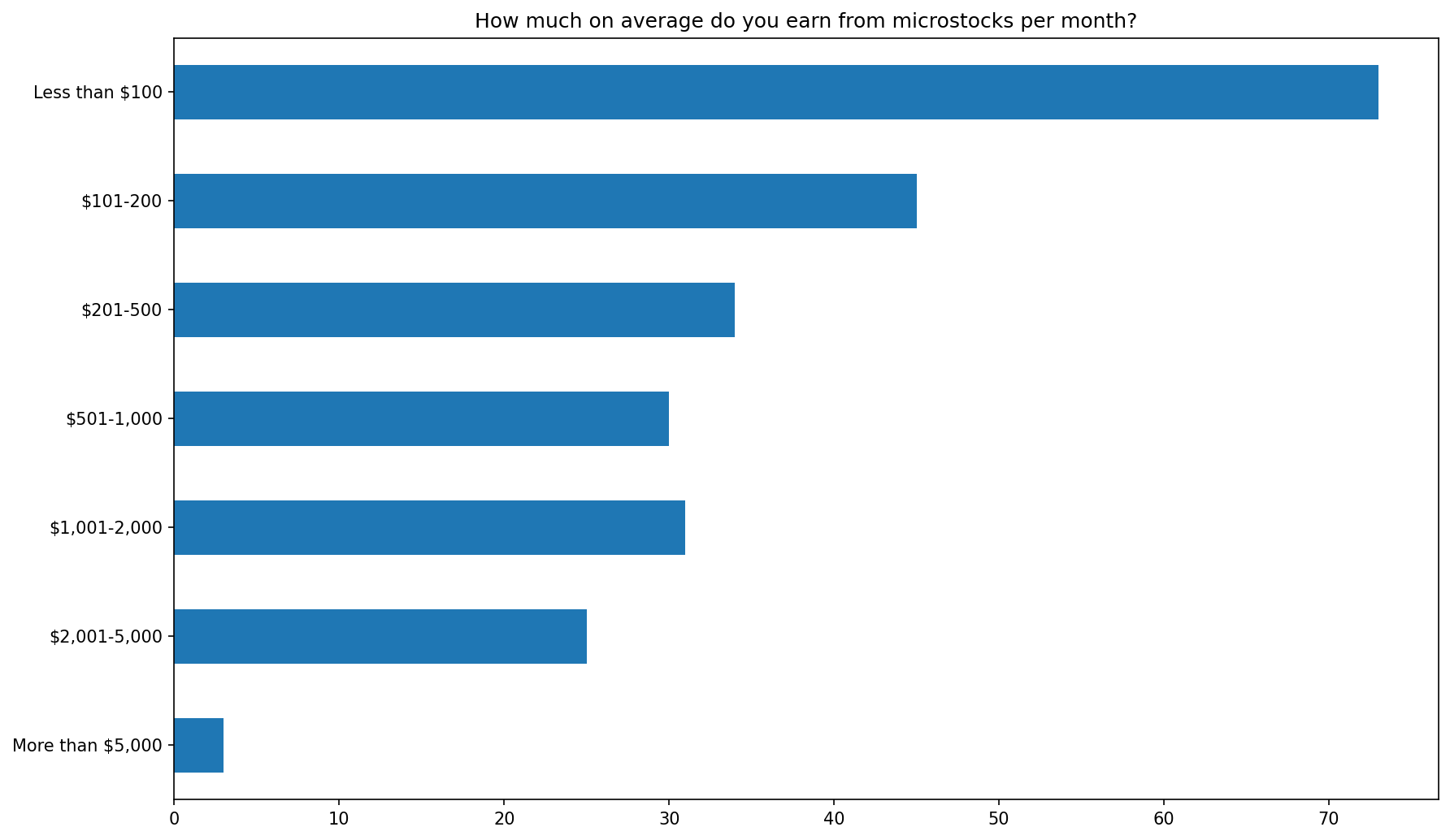

Overall, contributors are divided into the following buckets by monthly earnings:

How much on average do you earn from microstocks per months?

Although the Less than $100 bar is the largest, it’s only 28% of total and more than 35% of respondents earn more than $500 per month. 15% of respondents earn more than $2,000 per month.

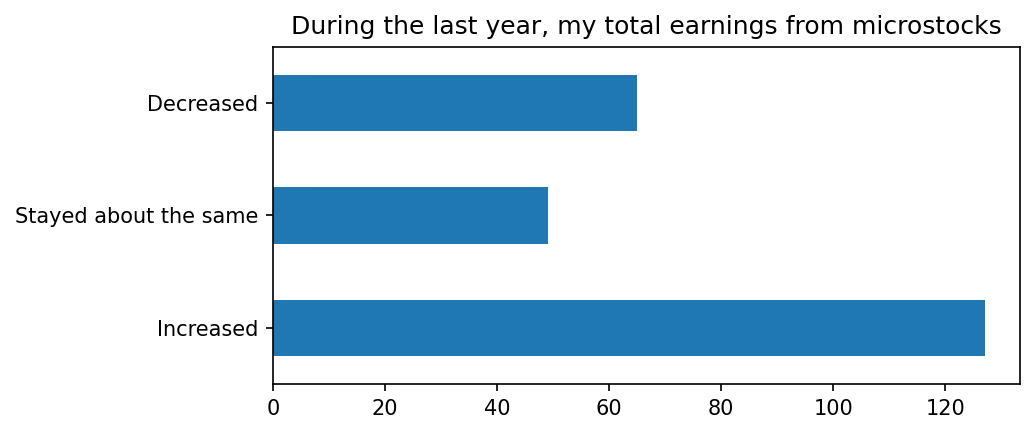

Earnings trend during 2024

However, what is, perhaps, more important, is the earnings trend during the last year.

Here about 25% of respondents report decreased earnings, about 20% report earnings staying the same and around 50% of respondents report increasing earnings! This is hard data to the contrary to general “outcry” about diminishing returns from microstocks.

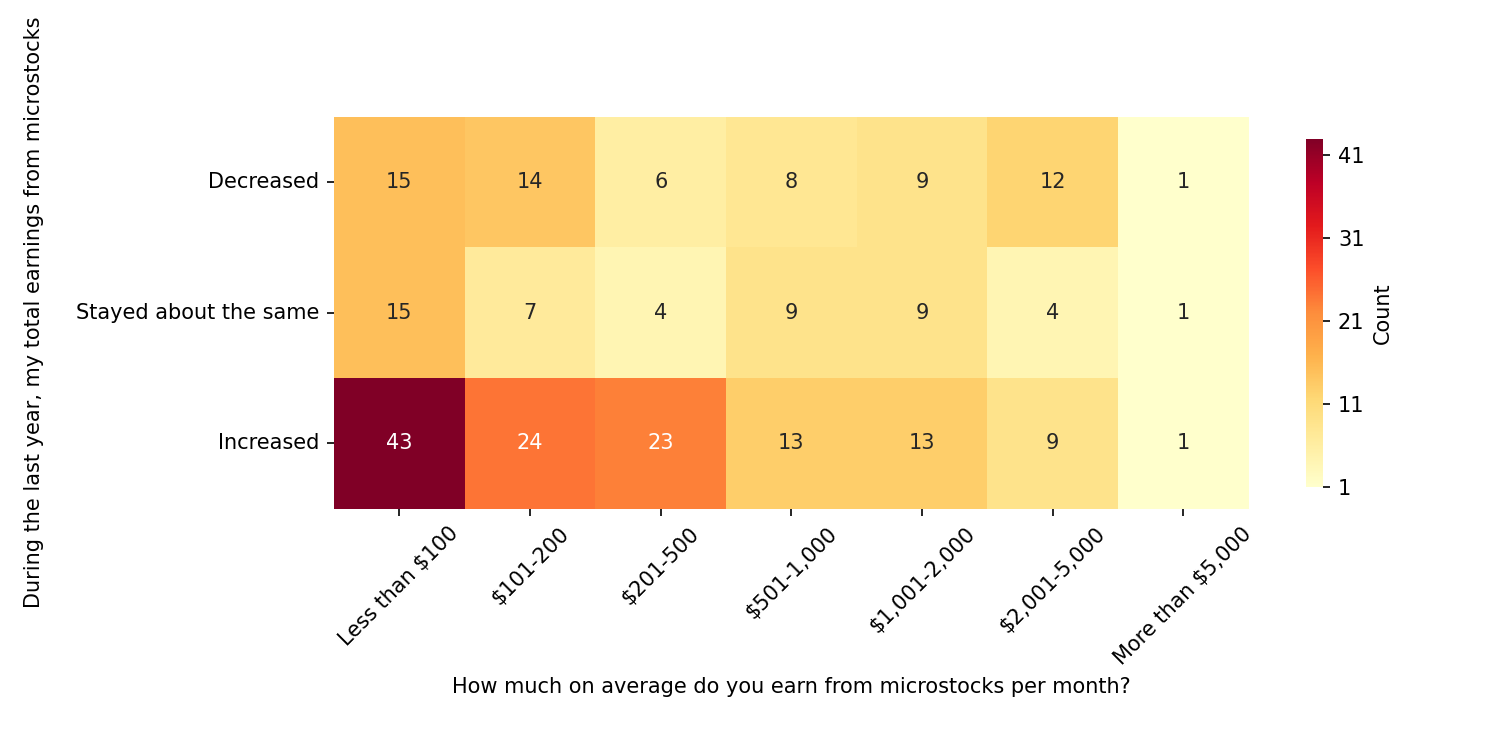

Then we can split these responses by earnings levels buckets:

Respondents report a lot of growth (“Increased” group) up to $500 per month, after which it noticeably slows down up to $2,000 and then slows down even more. Largest decrease is reported in the lower-earnings groups up to $200 per month (first two columns), after which it flattens out. Another interesting observation is that $2,000-5,000 group has reported slightly more earnings decrease, comparatively to the increase.

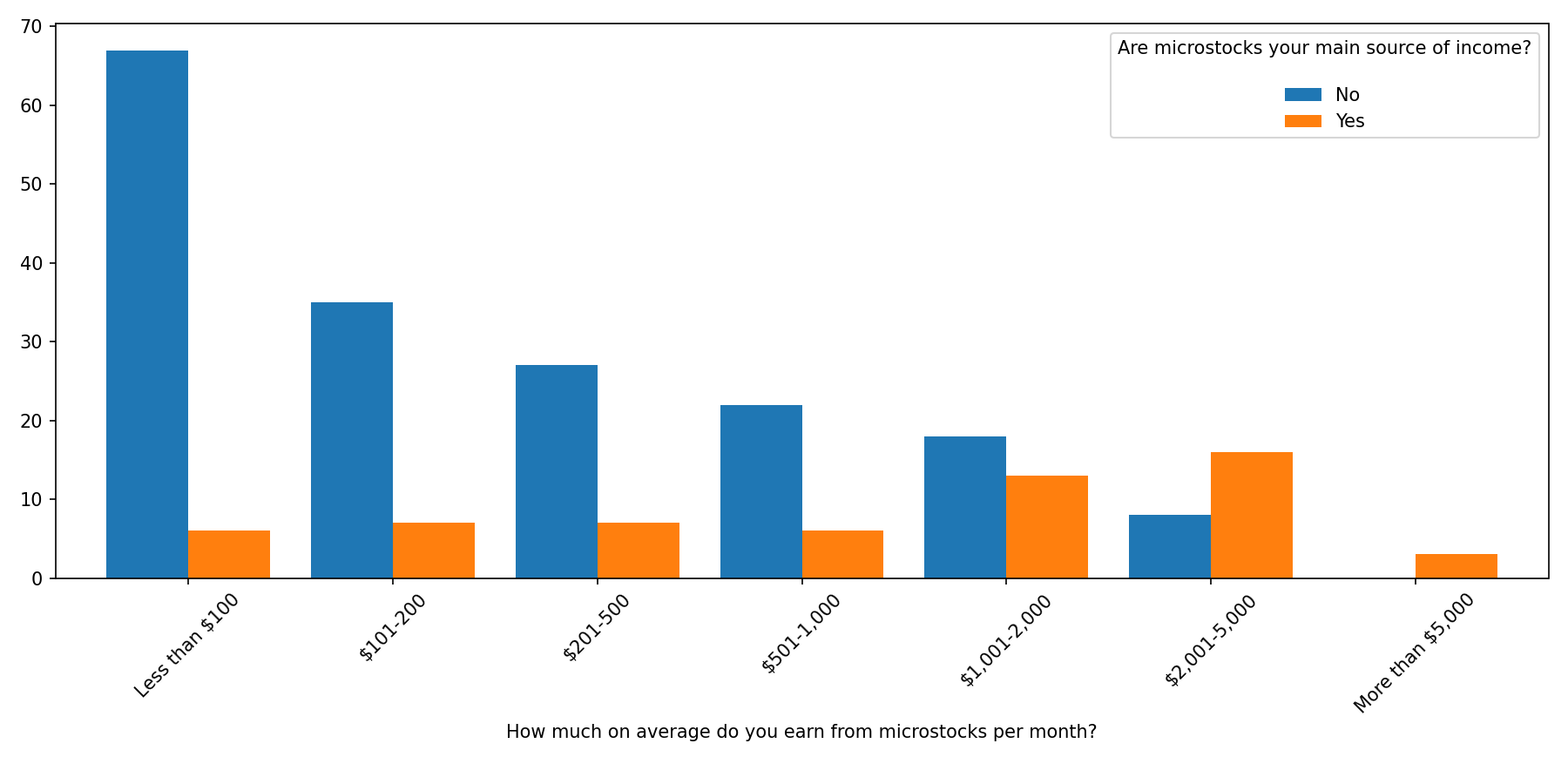

Microstocks as the only source of income

Although it’s very sad that for some people even $100 per month from microstocks constitutes a “main source of income”, the data is rather straightforward. Microstock earnings start to become main source of income around $1,000-2,000 per month and overtake other income, starting from $2,000 per month. This means that upon reaching $1-2K per month, people can fairly safely declare it a “success”.

Factors that influenced income

Years of experience

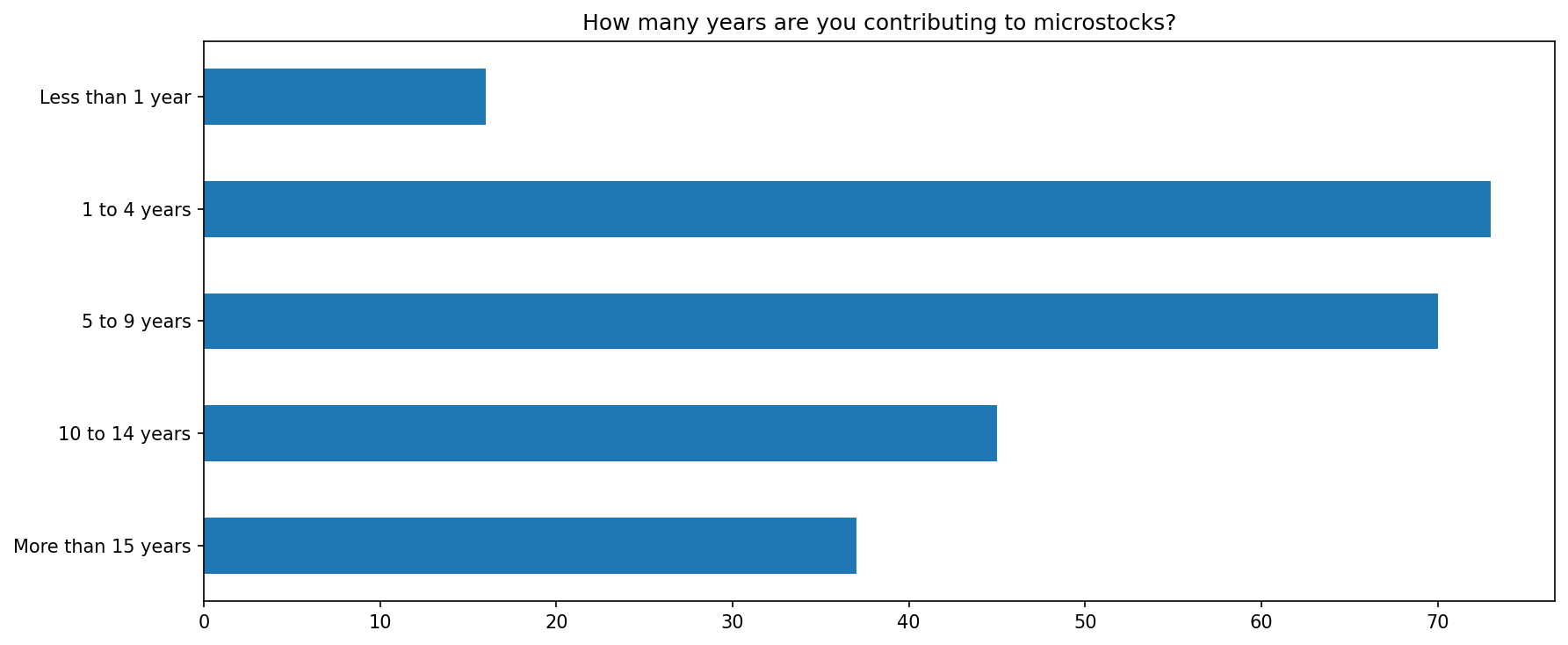

More than 66% of microstock contributors, who responded to the survey, are experienced contributors with at least 5 years of experience. Only about 8% of respondents have less than 1 year of experience.

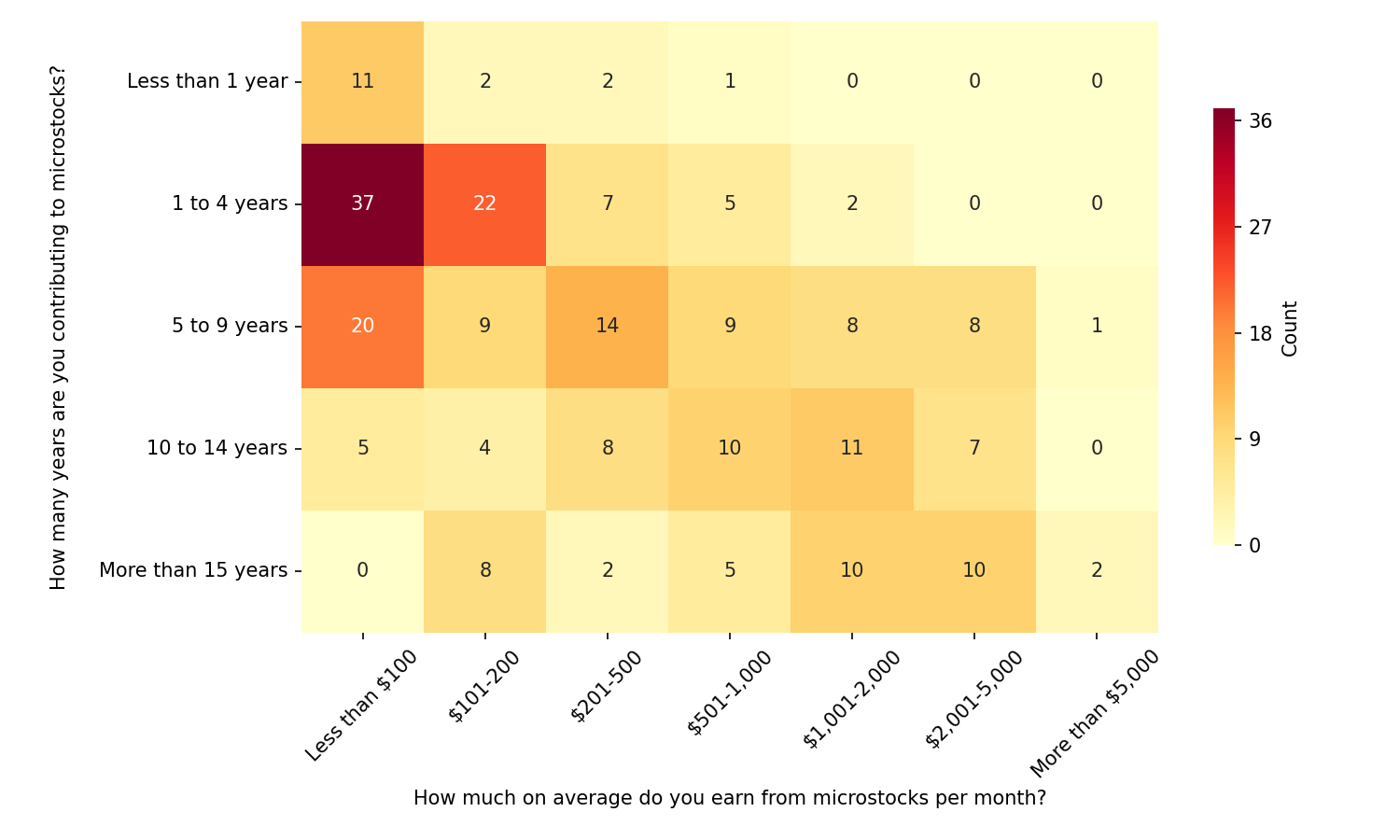

First obvious thing to check is how earnings depend on years of experience in the field.

There’s quite a lot of unpack. First of all, first-year contributors are statistically unlikely to cross $100 per month barrier. Secondly, 1-4 years of experience group seems to be the breaking point: most are stuck under $200 per month ceiling (first two columns), but once you cross the 1-4 years threshold, things seem to even out. I would offer an explanation that during 1-4 first years on microstocks you are figuring them out and they make or break you. People, who “survive” and learn - grow more “organically” later (as shown in the more “even” bottom rows). People, who give up and abandon it, make it only to statistics, such as this chart has to offer.

Also, if you squint and look at the chart again, you can see the “diagonal line of experience” that shows that in general with more years of experience you are likely to earn more.

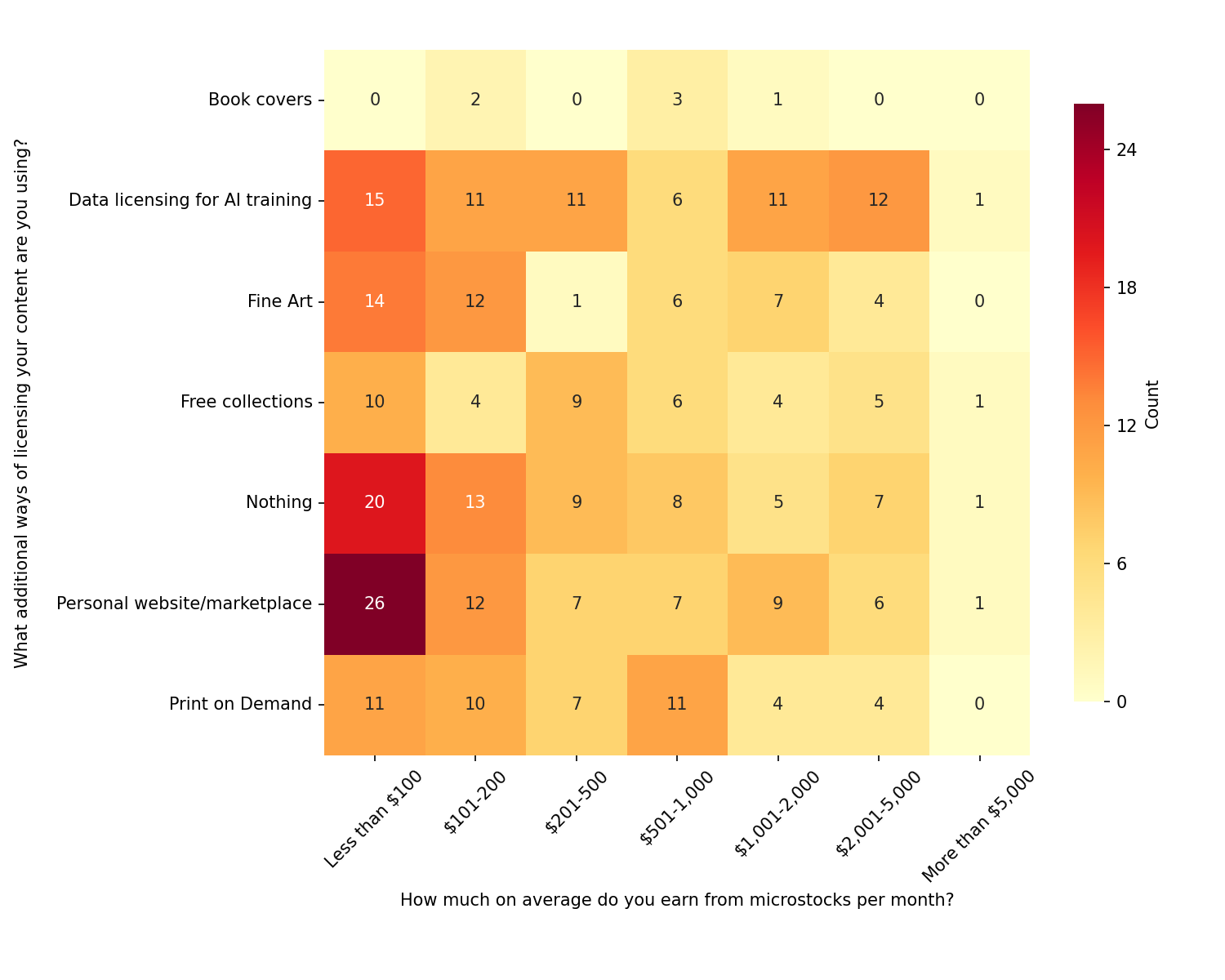

Additional ways to earn money with the same content

There are other things beyond microstocks, such as Print on Demand, licensing for AI training, personal website or Book Covers. Here we’re exploring their influence on monthly income.

The first thing I can notice is that people, who earn less than $200 per month (first 2 columns) are trying out everything and it’s the best way to proceed. Something will work out and something won’t, but if you don’t try, you don’t know.

The second thing is that respondents of this survey are quite unilaterally licensing their artworks for AI training, which agencies are paying some additional money for. While barely anybody is actually selling Book Covers (it’s also harder to get there!), Print on Demand and personal marketplaces are used by many. Free collections are also popular as those serve both as “free marketing” and agencies are paying a small “bonus” for enlisting your work there.

Also, not surprisingly, people who earn more than $5,000 per month, generally don’t bother with any of those.

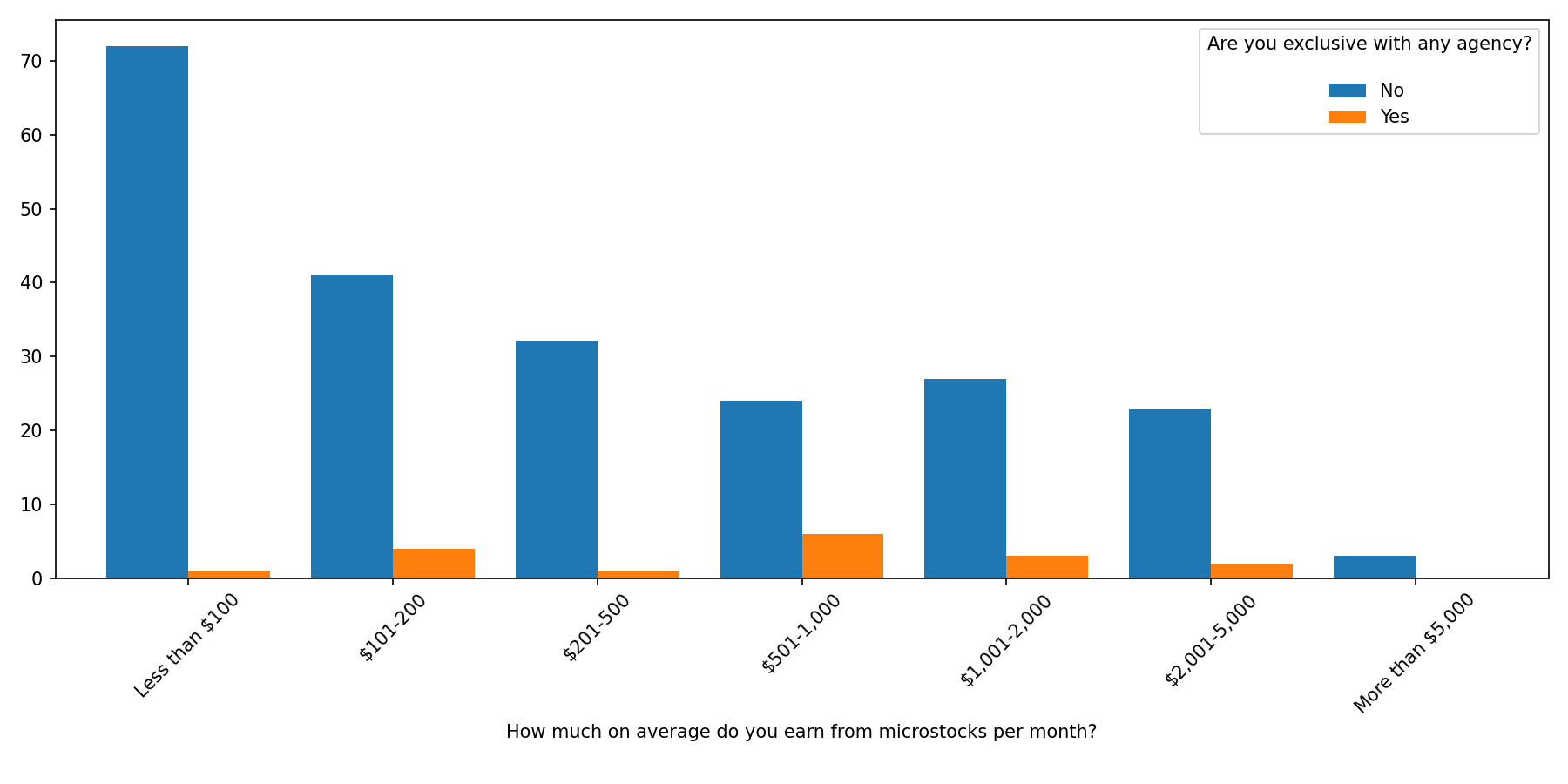

Exclusivity vs Non-Exclusivity

Another question worth asking if exclusivity nowadays brings a premium income.

To which the answer is a definite “No” (at least in the sample of this survey). Exclusivity is found in small amounts after $500 per month, but does not seem to be prevalent at large.

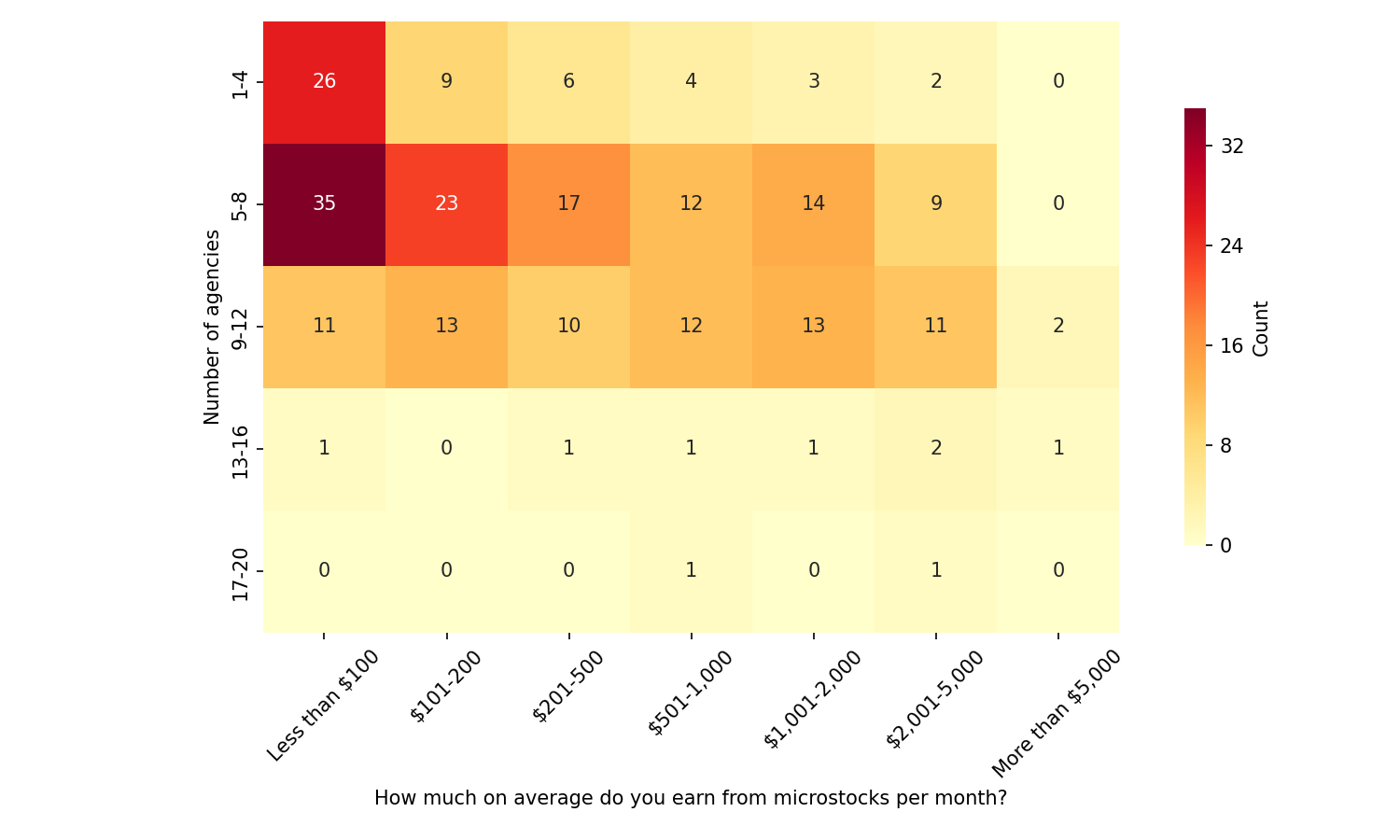

Now let’s look at the opposite question: how much earnings depend on the number of agencies people upload to. Here we split the number of agencies, that people upload to, into buckets of size 4.

Based on this data, the vast majority of contributors stop bothering after 12 agencies (and rightfully so). Actually, 5-8 and 9-12 buckets of agencies seem to be surprisingly equally inhabited by the people of all earnings buckets. That suggests that until you know why you are doing this, you can pursue 5-8 best agencies and have a piece of mind as data suggests it’s enough. Another learning is that the absolute majority is uploading to more than 4 agencies, which is also a good thing to do, as this group (1-4) is thinning out high-earners along the money axis.

Tracking earnings

Angle here is to find out if tracking earnings offers any benefits and if yes, to whom.

![]()

Although majority does not track, data suggests that many people do track their earnings and it’s great! Apparently, a huge chunk of contributors of all earnings levels is tracking their earnings using custom solutions, which seems to be enough for them. So you don’t need to pay for StockPerformer (does not look like many do anyway).

From people who earn money, most fervently are tracking earnings $1,000-2,000 group, but overall most earning groups are tracking earnings. I would argue that tracking allows them to see what is selling and what is not and to optimize content production. And the two “peaks” ($200-500 and $1-2K) suggest to me some kind of “breaking points” when people are figuring out their way in microstocks and data does help here.

Work

In this section, we will investigate how much people are working and what was a game-changer for them, if any.

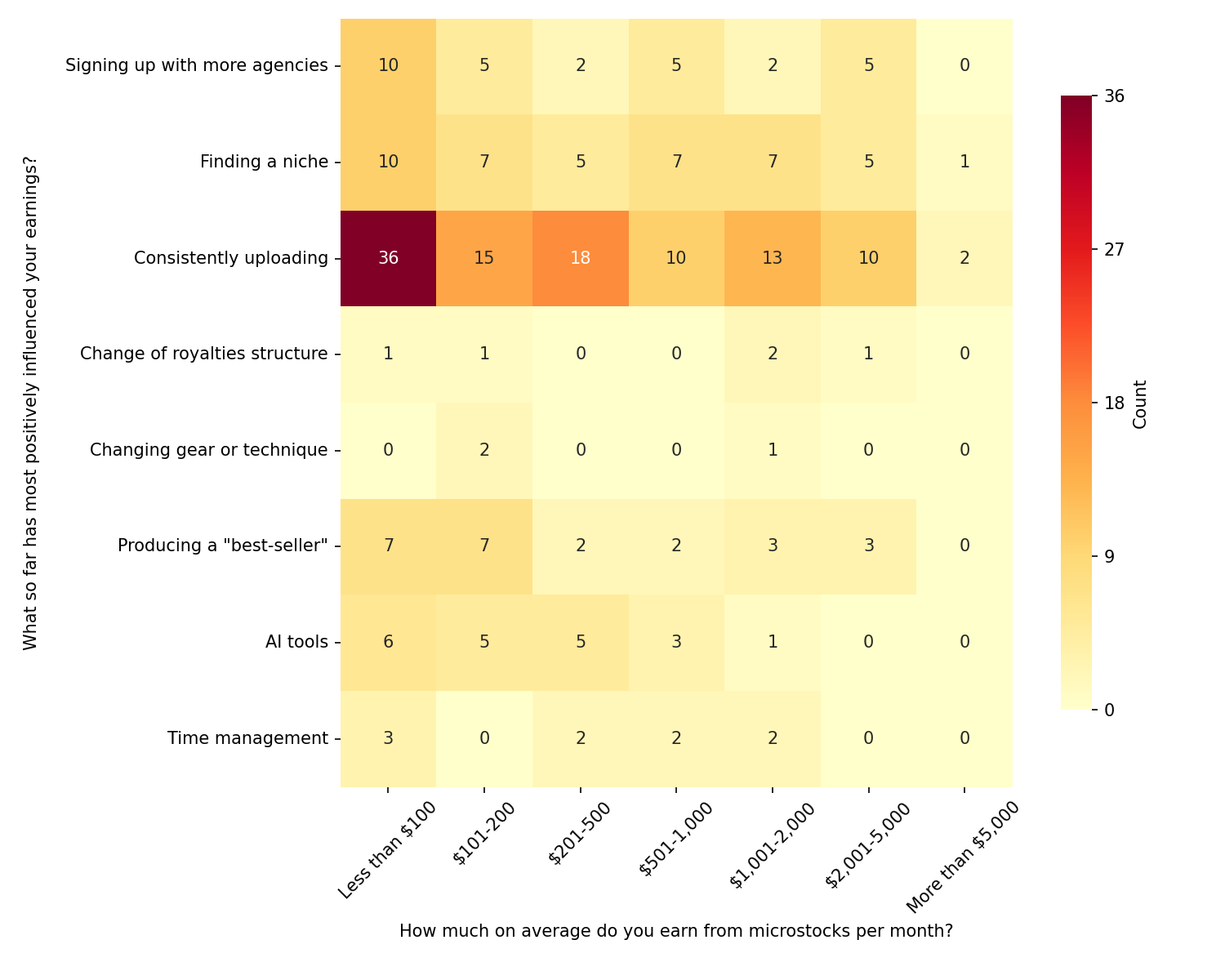

Most positive influence on earnings

We asked what was the single largest thing that has influenced their earnings (in their opinion) and here’s what people said. A bit over half (!) of the participants marked “Consistently uploading” as the key factor affecting earnings. Remote second place, with only about 16% of responses was “Finding a niche”.

Despite the other obvious things to discuss, unbelievably there were few people, who were positively affected by the royalties restructuring in many earnings groups.

Almost everybody marked “Consistently uploading” as the key thing that has had a positive influence on earnings. Especially it has helped lower-earnings groups. Another popular choice was “Signing up with more agencies” that should not surprise you after exclusivity section in this blopost. Second most popular choice was “Finding a niche” - it is the most consistent response for all earnings levels after “Consistently uploading”. Notable mention of “Producing a best-seller” (also known as “Luck”) was also consistently (albeit less frequently) marked as an answer.

Funny to note that “AI tools” was mentioned only for lower-income buckets and even there it was thinning out, the more income you get. And, maybe, also funny to see that “Time management” (also known as “Productivity culture”) did not have as much impact as one could hope.

Work hours

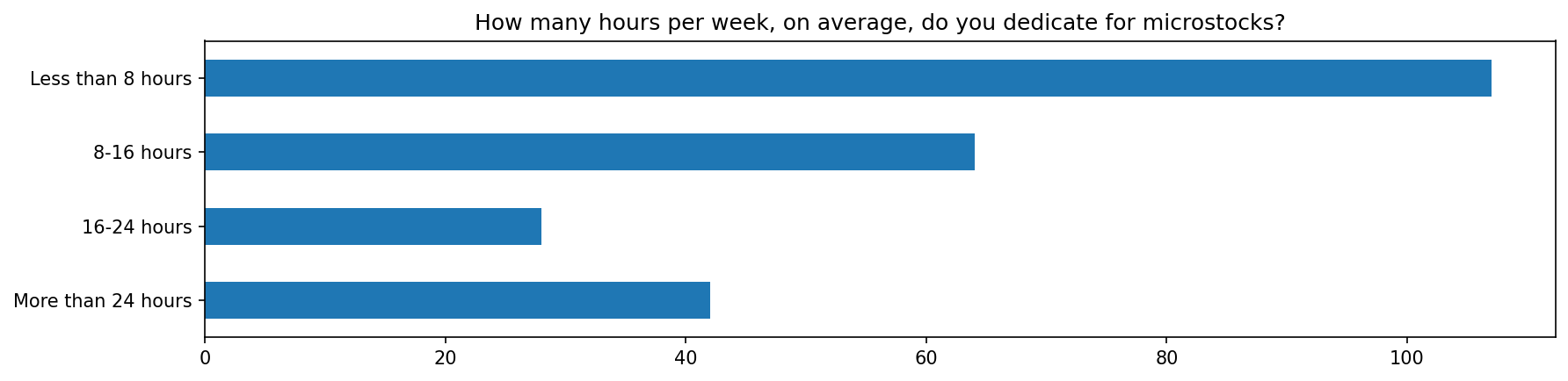

Interesting to see how much time people spend working for microstocks per week.

Overall, the vast majority works less than 8 hours per week! The 8-16 hours buckets seems to be the second most-popular option.

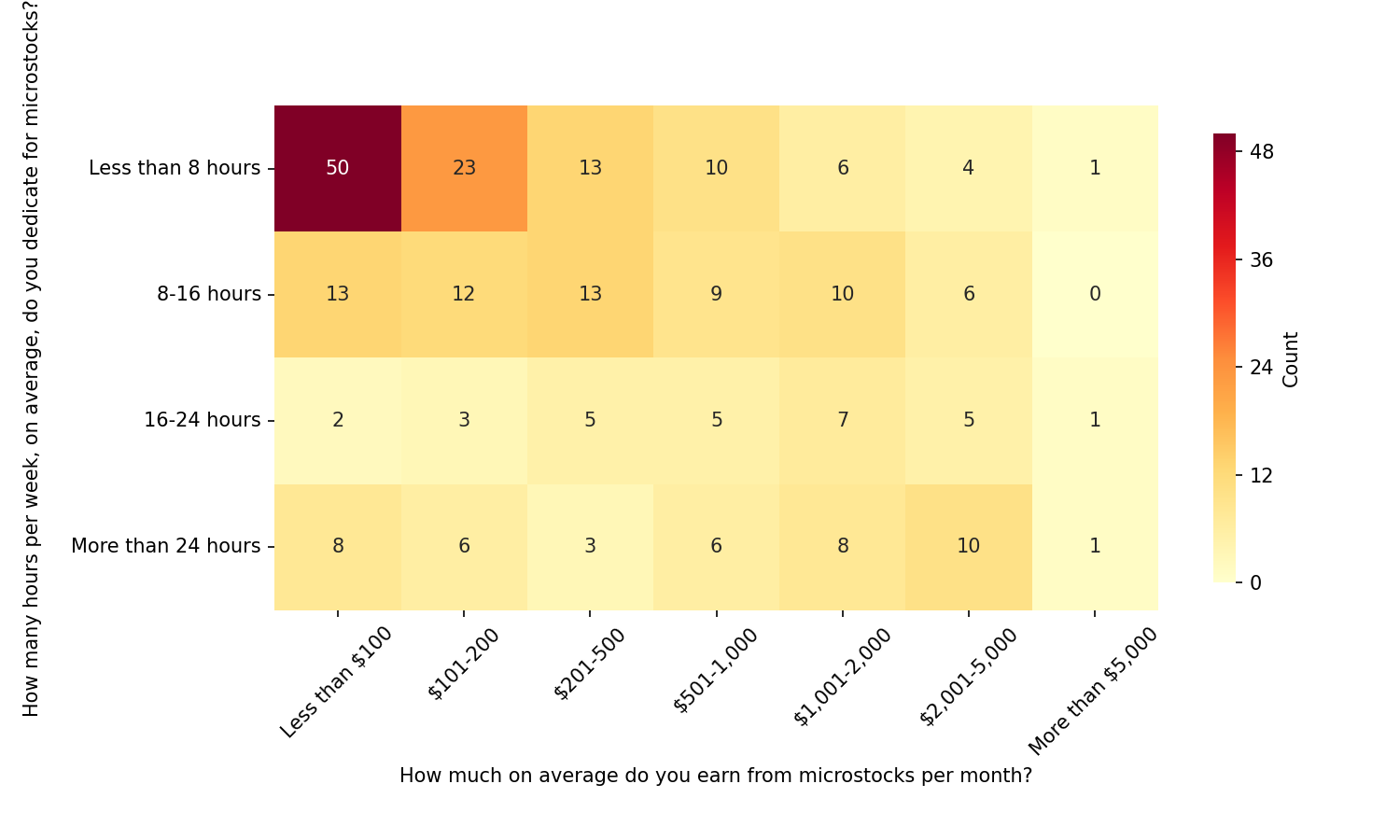

Hours influence on earnings

First, we check how these working hours translate into earnings.

The fact that vast majority of low-earners (first 2 columns) works less than 8 hours per week might suggest that microstocks are indeed not a “get-rich-quick” scheme. Higher-earnings contributors are progressively thinning out of this group, but it is not clear exactly why. Could be just they they found their “passive income” level and work less, or have found another job altogether and keep microstocks on the backburner.

Data seems to suggest that the second group of 8-16 hours per week seems to be almost equally inhabited by all earnings buckets, suggesting that it might be a “Goldilocks zone” for many. Also not surprisingly is to see the “darker” corner of the people who earn $2,000-5,000 and are working more than 24 hours per week (and, I assume, it’s actually closer to “full-time”).

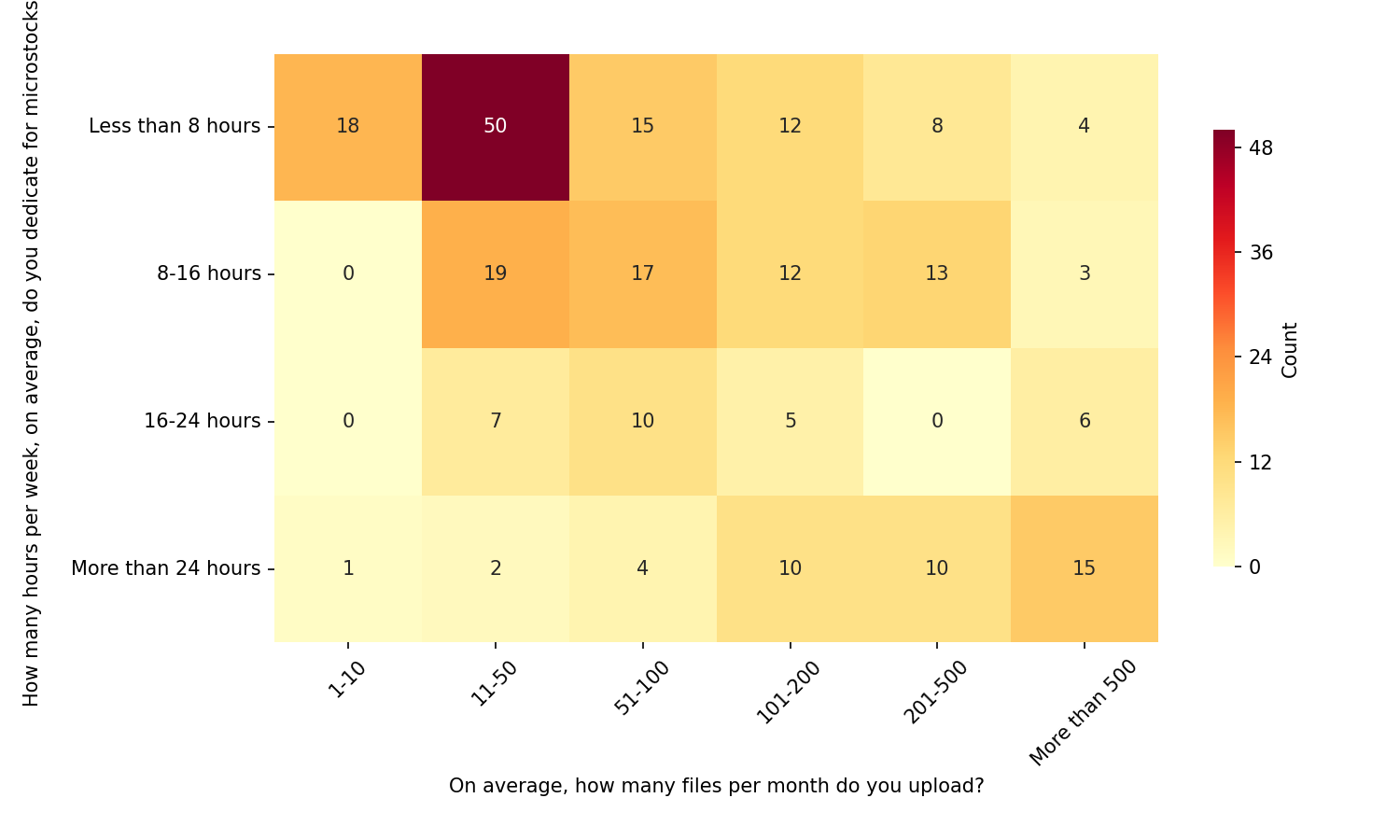

Hours needed to produce a number of assets

Let’s see how many assets can people produce by working a certain amount of hours.

It actually seems that people who work less than 8 hours per week can produce 11-50 monthly uploads most reliably. 8-16 hours per week group is reliably producing 11-100 monthly uploads (two buckets 11-50 and 51-100 combined), with other being less likely. Note the much darker bottom right corner of high-earning and high-working people who are producing more than 500 uploads monthly, working over 24 hours per week.

Interesting to see that working 16-24 hours per week do not reliably yield more monthly uploads. It could be that this group are just the same as 8-16 hours per week group, just works “slower” (thus, needs more time).

You can use this table for rough estimates how many files you are likely to produce, depending on how much time you can invest in microstocks.

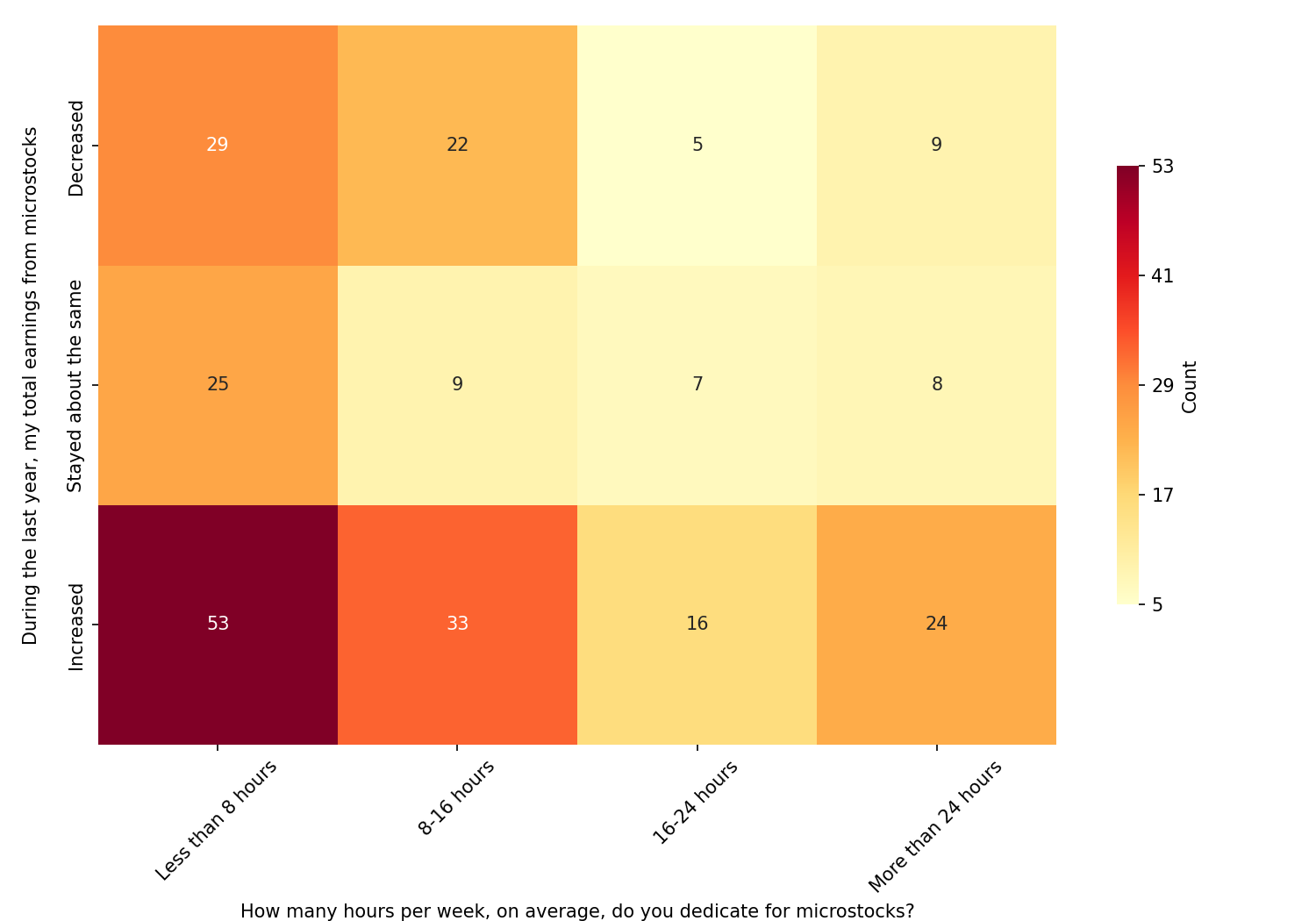

Hours in effect to earnings increase

If we spin the same data with regard to earnings trend, here’s what the picture looks like.

Interesting result is that, except of the group (last column) that works more than 24 hours per week (I assume, full-time), other time buckets are split equally between “Increased” group and “Stayed the same OR decreased” (sum of other 2 groups). Only the last group, that works a lot, reports consistent earnings “Increase”. To me that suggests that at lower time investment, you need to have some additional advantage, rather than just “clocking in hours”, to increase your earnings.

Risks

We asked contributors what they perceive as single largest risk to their earnings.

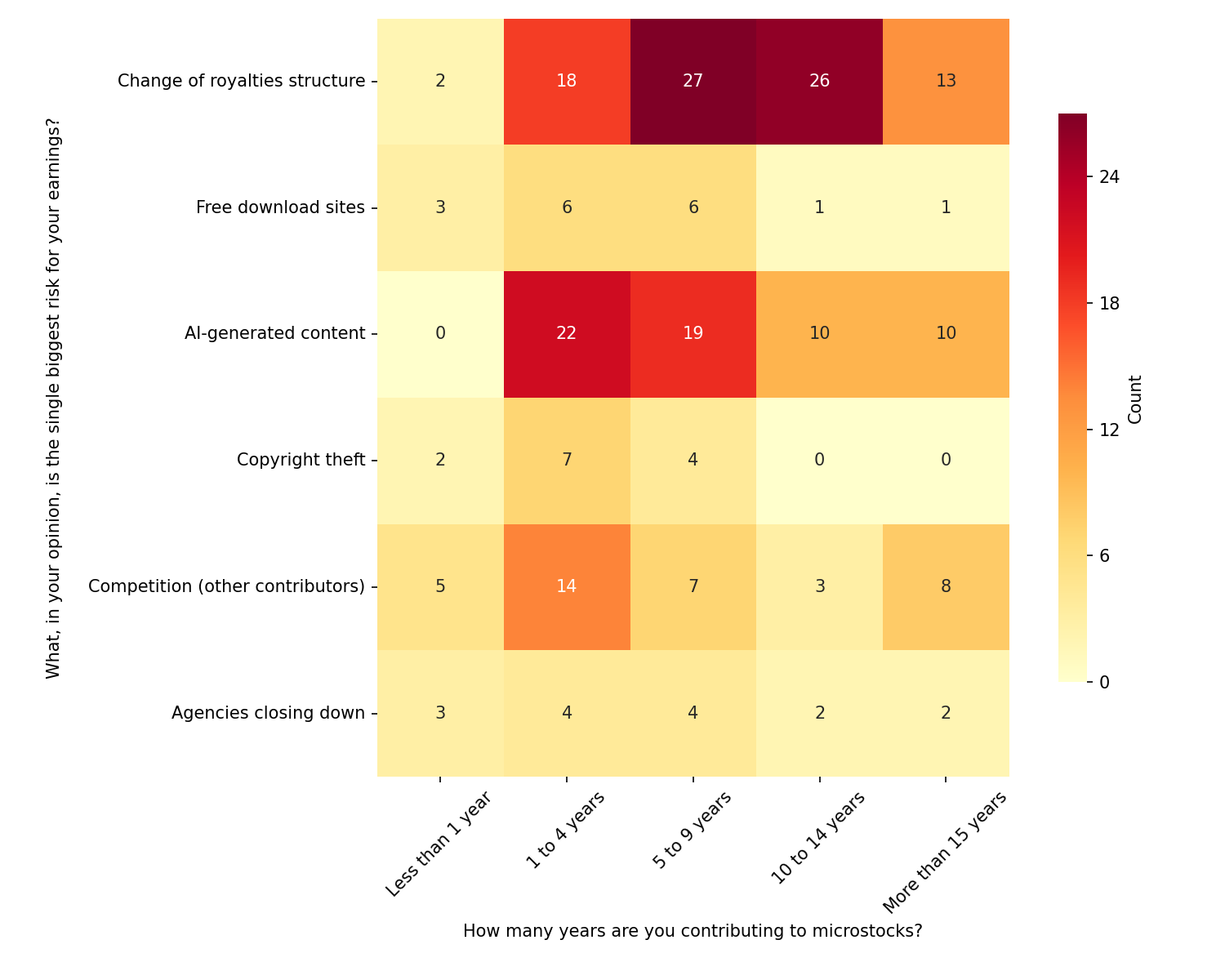

Risk with regards to experience

I assume that first-year contributors don’t worry about most of the things because they haven’t witnessed royalties changes or agencies closing down, competition is virtually so overwhelming that it’s not a primary risk, and AI-generated content is not a risk as they are doing it themselves.

For others, two rows are unanimously “dark”: “Change of royalties structure” and “AI-generated content”. Interesting that most worried about changes to the royalties structure are veterans with 5-15 years of experience. As for AI-content, it scares mostly contributors with 1-4 years in the industry and thins out for more experienced groups. Hard to know what is this attributed to, but could be that more experienced contributors are either sufficiently diversified (across agencies, content type etc.) or produce content that is less threatened (unique or complicated).

“Competition” is also scary enough for 1-4 years group and Over 15 years group. “Free download sites” and “Copyright theft” are apparently less scary issues (at least to more experienced contributors). “Agencies closing down” scares all groups equally, but not by much.

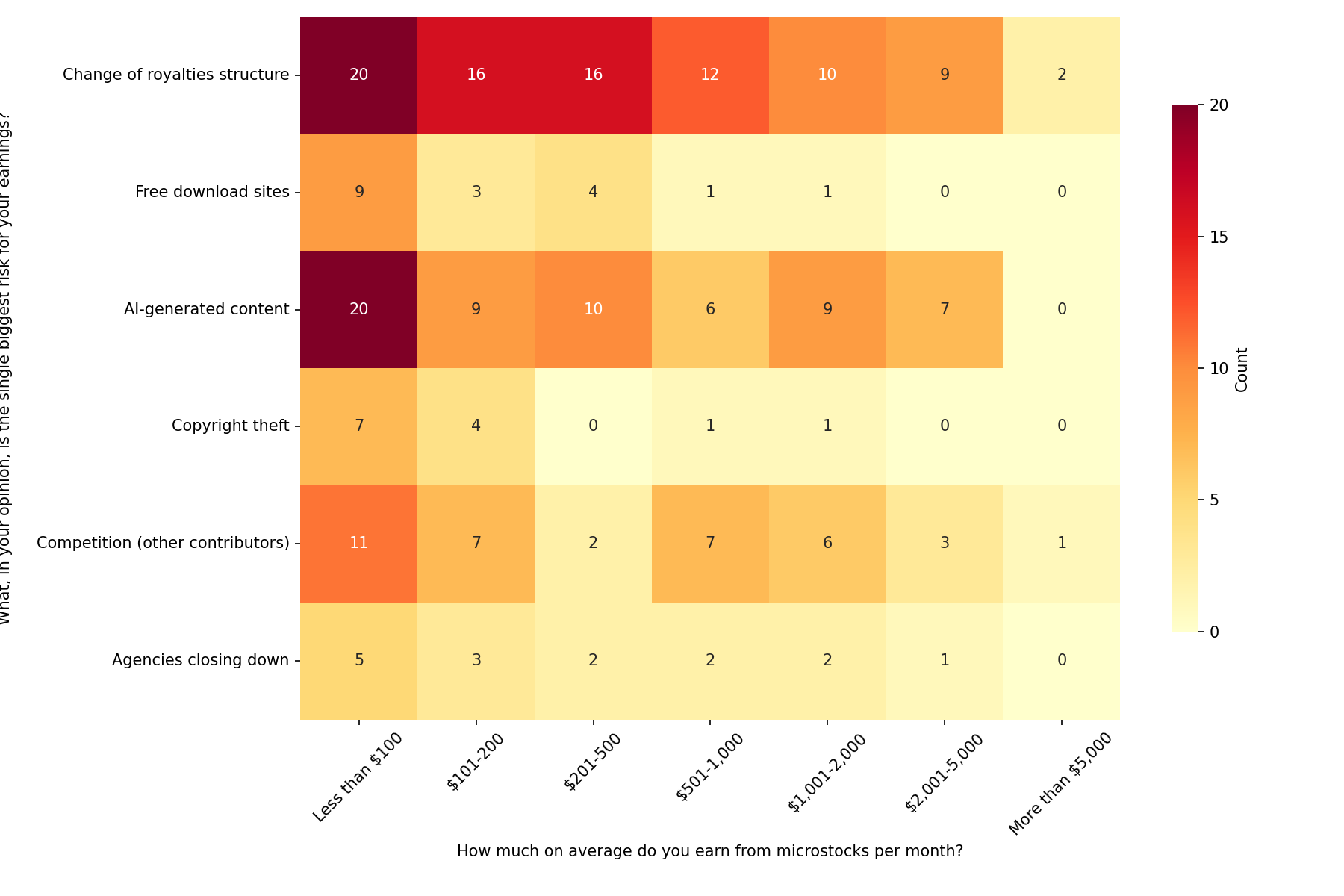

Risk with regards to income

Now, if we slice the same data, but with regard to monthly income, the picture is a bit different.

Overall, most scared of any threat is the lowest-income group, which makes sense as they don’t yet have a strong footing in the industry and everything is unknown. However, as income grows, the largest threats are still “Change of royalties structure” and “AI-generated content”.

The good news is that quite reliably the more money you make, the less scared of any of these threats you will be, based on the responses.

Final words

This concludes Part 1 of our microstock survey analysis, where we’ve covered earnings trends, success factors, and work patterns in the industry.

Stay tuned for Part 2, which will dive into the topics of content creation, keywording, and the impact of AI on the microstock market. To make sure you don’t miss these insights, subscribe to the newsletter below.